Volumetrica Trading - VolSys®

VolSys® is a professional trading platform with its main goal being volume profile analysis, time and sales, order flow, and footprint trading.

Volumetric Trading has also developed many proprietary indicators based on their experience of the market and recommendations from professional traders.

To view more available platforms provided by Edge Clear, please click here.

Request a Volumetrica Trading - VolSys Demo Powered by Rithmic

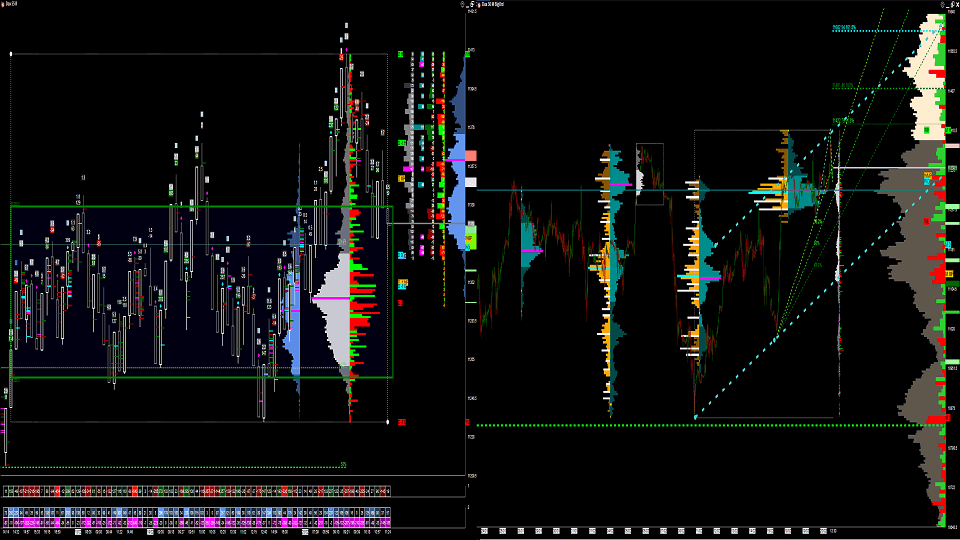

Volume Profile

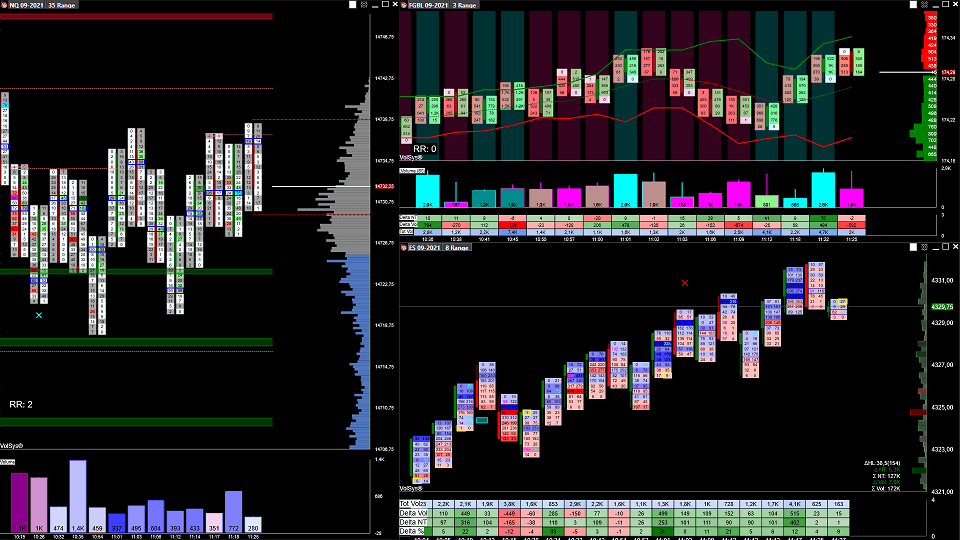

Order Flow Analyzer (Footprint®)

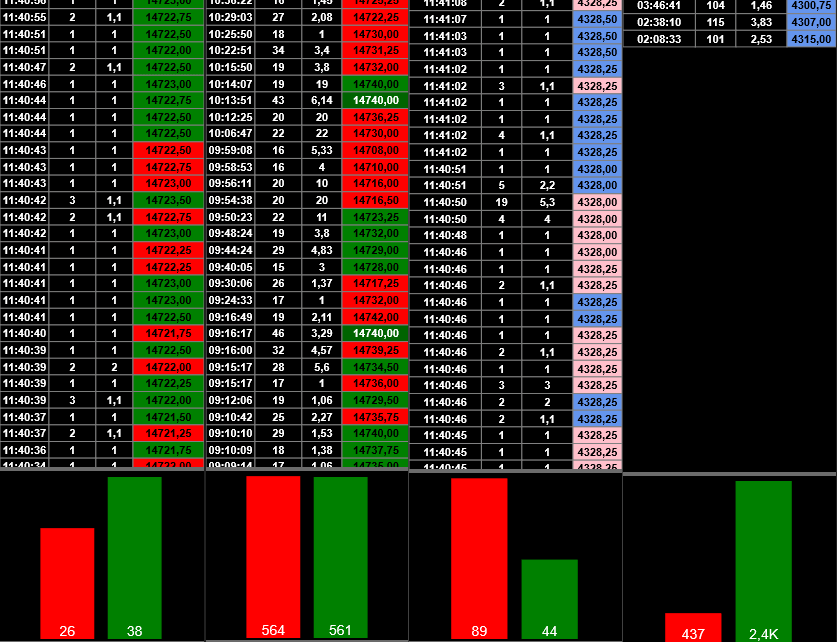

Advanced Time and Sales

VolSys® version of the Time & Sales tape (Advanced T & S) combines individual prints back together to easily see the market orders to their fullest extent. This allows traders to filter the size of orders to get a clearer picture of the order book.

You also have the option to enable sound alarms with the possibility to show other essential information including Iceberg Orders and Quantity Order entered.

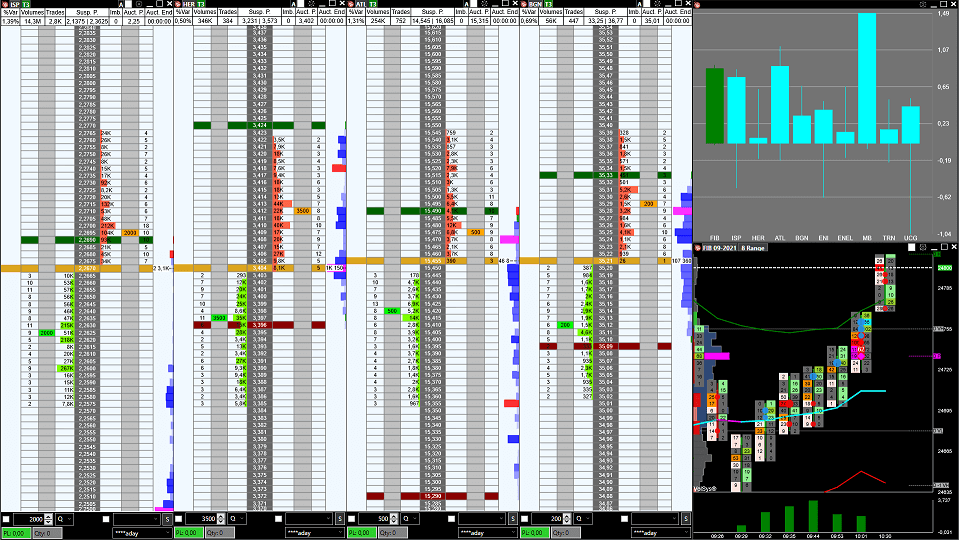

Trading Execution

VolSys® allows traders to connect to multiple data sources simultaneously. This allows the user to trade on one execution routing platform (Rithmic, CQG or others) while using a dedicated third party data feed provider (IQFeed, for example).

Traders can execute from the Advanced DOM or directly from the chart using OCO strategies. Traders have tight control and can break the position into small pieces and close them at different prices, or through fast order execution with shortcuts using their keyboard.