CME

Membership

Consultation

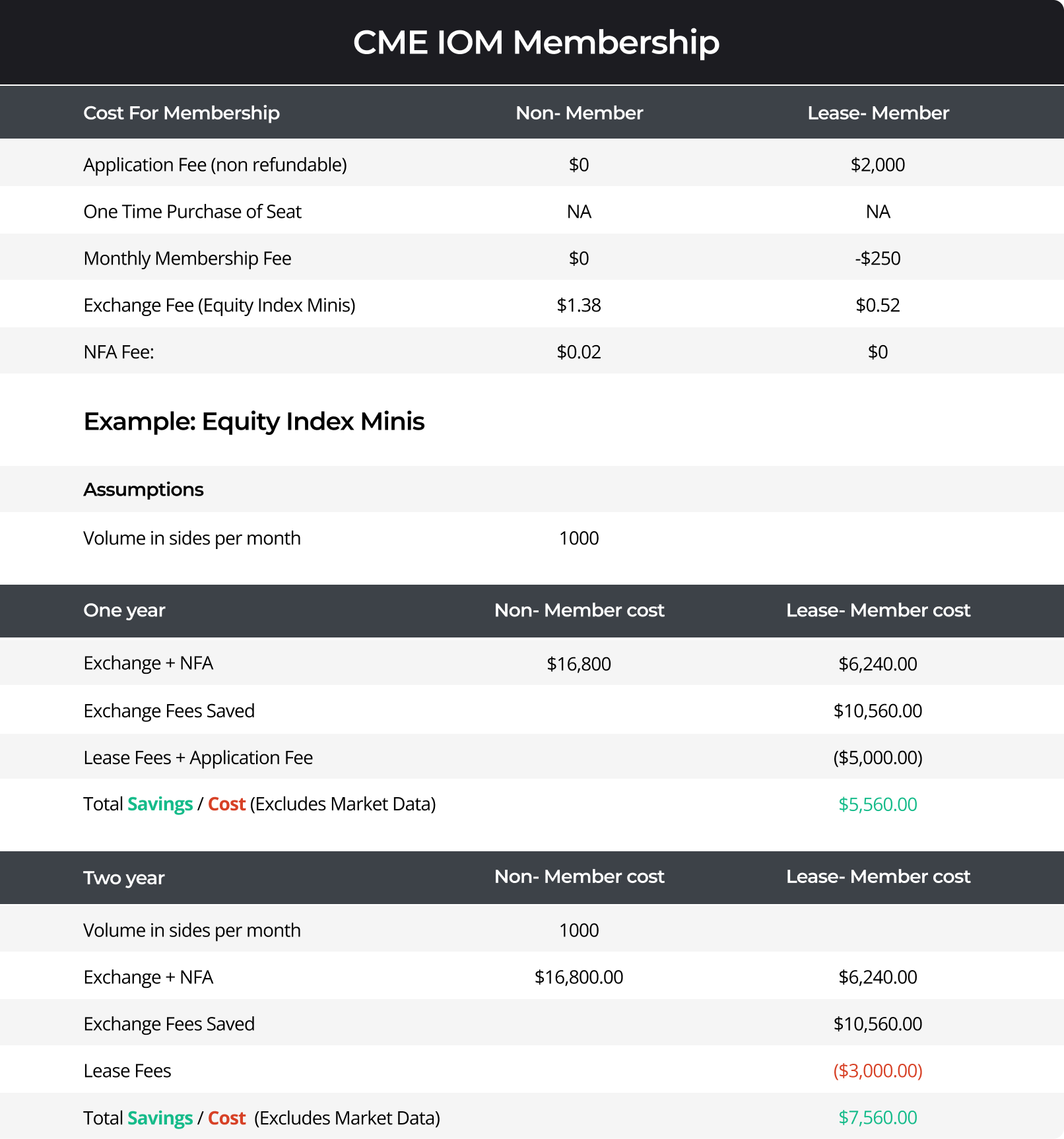

High volume traders of CME Futures products have the opportunity of reduced exchange fees by leasing a seat on the exchange. To view the complete breakdown of fees, please schedule a CME membership consultation with a personal broker by filling out the form below.

Our experts will calculate your total commissions to date and create a breakdown of the best membership structure for you. The process normally takes 15-30 minutes from start to finish.

Sample Membership Worksheet

Calculations do not take into consideration data fees. The information contained herein is believed to be accurate; however, EdgeClear makes no representation as to the accuracy of the information contained herein.

Fill out the form below to schedule a CME membership consultation and start to save!

"*" indicates required fields

Individual Membership

There are four divisions of individual CME memberships representing the four levels of access to CME products. Individual memberships at CME became attached to a Class B share in Chicago Mercantile Exchange Holdings Inc. when the exchange de-mutualized and became a publicly traded company in 2002.