Volumetrica Trading-Volbook®

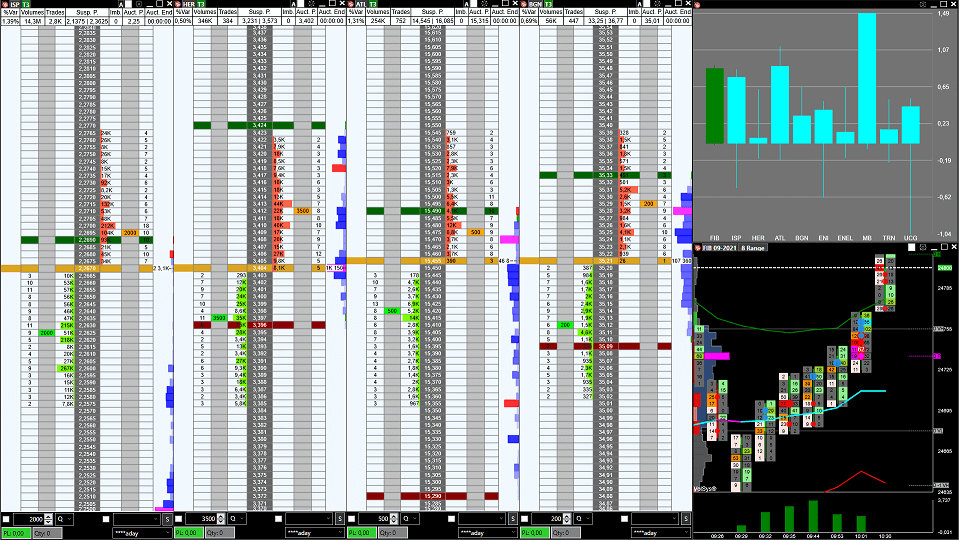

VolBook® is a professional volume trading platform that offers an innovative way to display and analyze the market depth. Volumetrica built a heatmap with a proprietary display algorithm.

Volumetric Trading has also developed many proprietary indicators based on their experience actively trading the markets and from recommendations provided by professional traders.

To view more available platforms provided by Edge Clear, please click here.

Request a Volumetrica Trading - Volbook Demo Powered by Rithmic

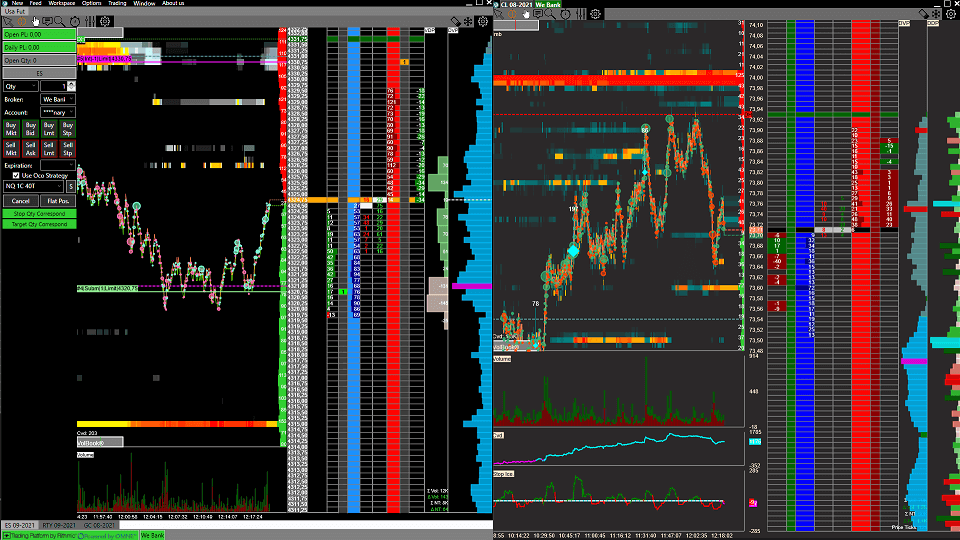

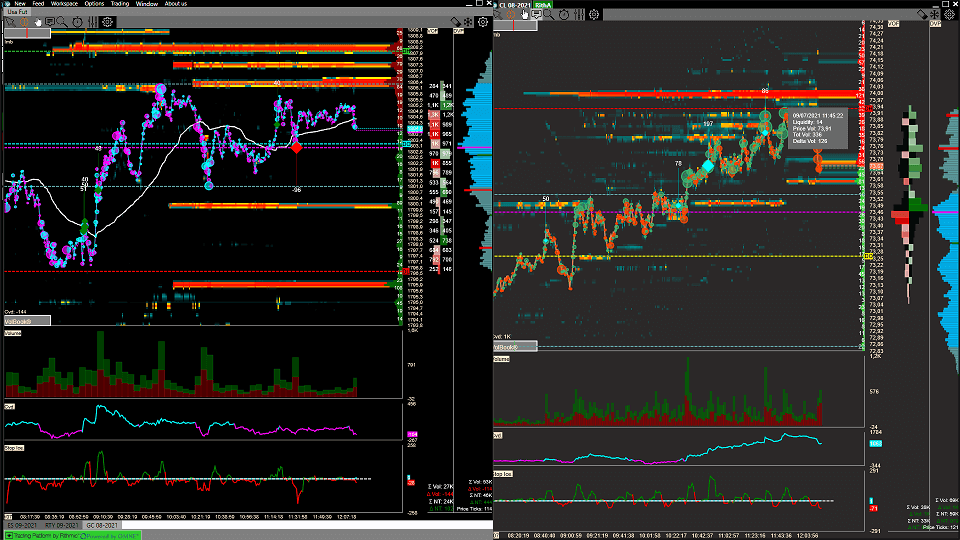

Book Liquidity Chart (Heatmap)

The heart of the platform is the market depth analysis through a heatmap where each price level changes color based on the quantity of limit orders placed at that price, helping traders to identify support and resistance zones. VolBook® supports the full depth where it is available, so it is possible to view over 1000 levels.

In addition to real-time depth, VolBook® also offers a historical depth of the day. Volume profile is one of the most powerful volume indicators, in our opinion, because it highlights the most traded price levels and how they have been executed thanks to the delta profile.

Volume Bubbles

VolBook® combines the analysis of Level 2 (market depth) with Level 1(time and sales) using the Volume Bubbles indicator. The trades are displayed as bubbles. Their size depends on the amount of volume executed. They are colored according to the side that the aggressor traded on (buyers or sellers).

This function can help you identify the book action like spoofing, layering, or when the limit orders are really executed. The indicator is fully customizable in terms of colors, filters, grouping mode, and other features

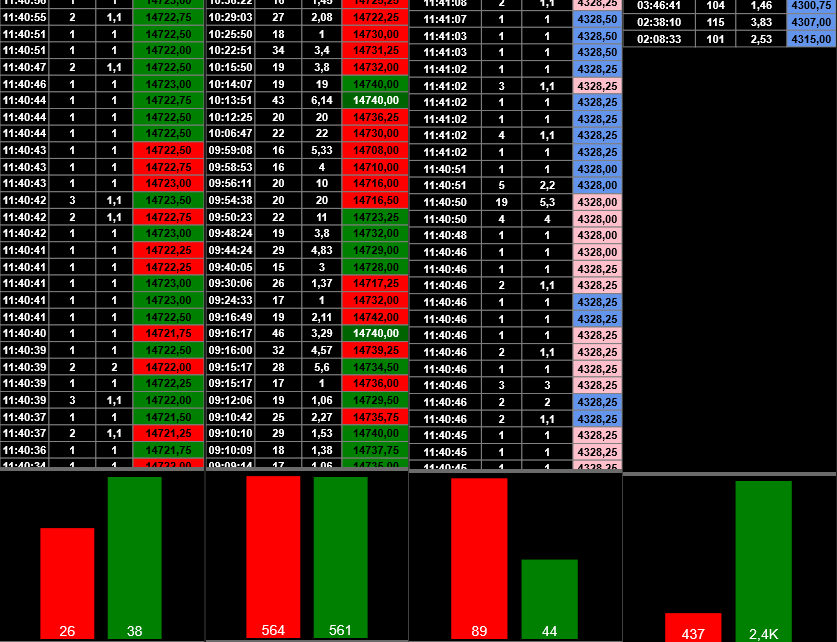

Advanced Time and Sale

VolBook® version of the Time & Sales tape (Advanced T & S) combines individual prints back together to easily see the market orders to their fullest extent. This allows traders to filter the size of orders to get a clearer picture of the order book.

You also have the option to enable sound alarms with the possibility to show other essential information including Iceberg Orders and Quantity Order entered.

Trading Execution

VolBook® allows traders to connect to multiple data sources simultaneously. This allows the user to trade on one execution routing platform (Rithmic, CQG, or others) while using a dedicated third-party data feed provider (IQFeed, for example).

Traders can execute from the Advanced DOM or directly from the chart using OCO strategies. Traders have tight control and can break the position into small pieces and close them at different prices, or through fast order execution with shortcuts using their keyboard.