May 01,2025 @02:00 PM

How do you measure and define whether your trading plan has an edge? How do you actually track what is working, and what is not working in your trading setups? Are you risking too much in any given trade, or holding on to losing trades for too long? Do you have reliable setups?

For discretionary traders and professionals alike, these questions are paramount for sustained growth. As with any investment, the risk of trading futures and options can be substantial. Trading without a measurable edge is akin to running a business without having a defined business plan. As a trader, you need to know which markets you plan to trade, what markets you trade well, how much you are willing to risk, what quantifies a good setup, and what times you should be sitting out.

A Tool Like EdgeWatch Can Help

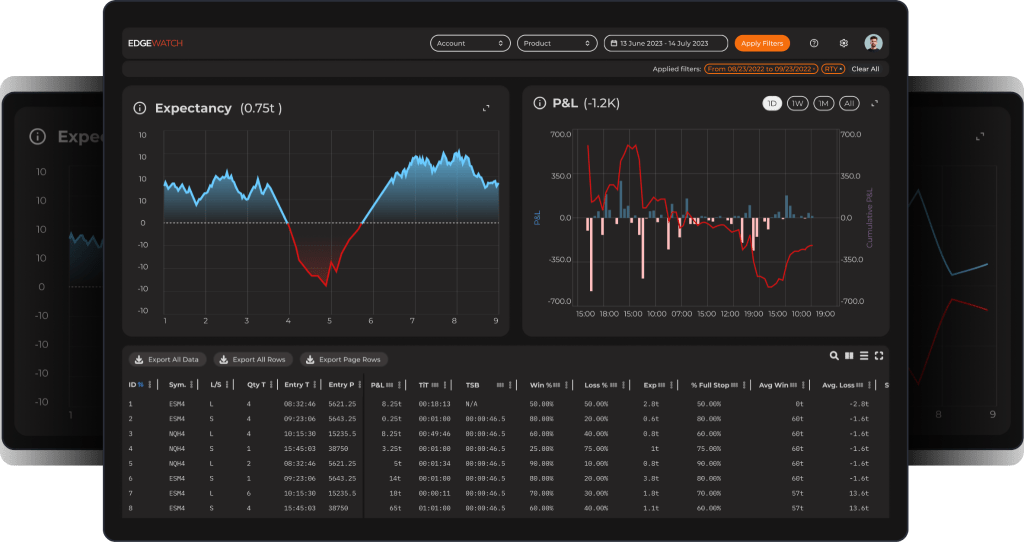

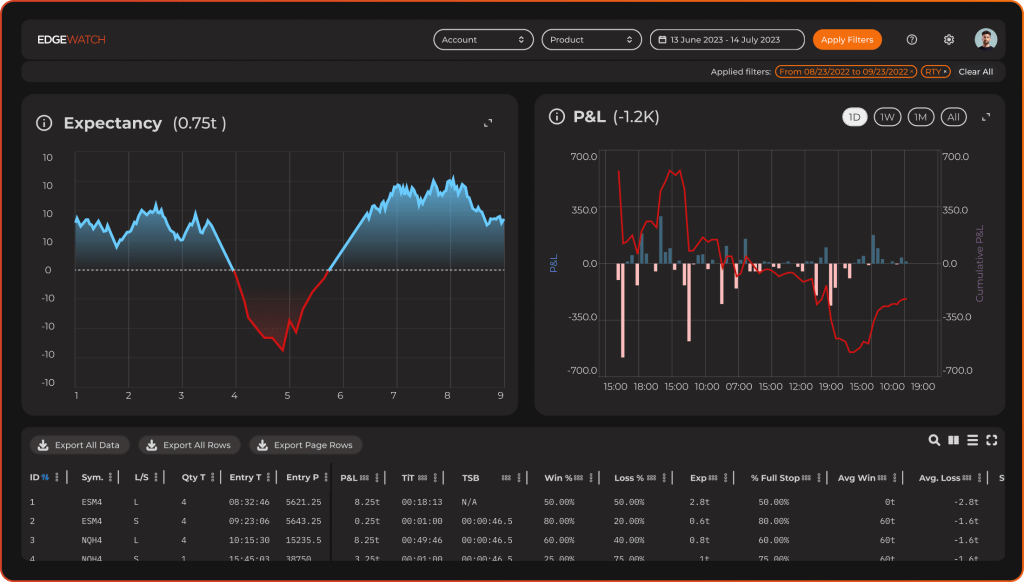

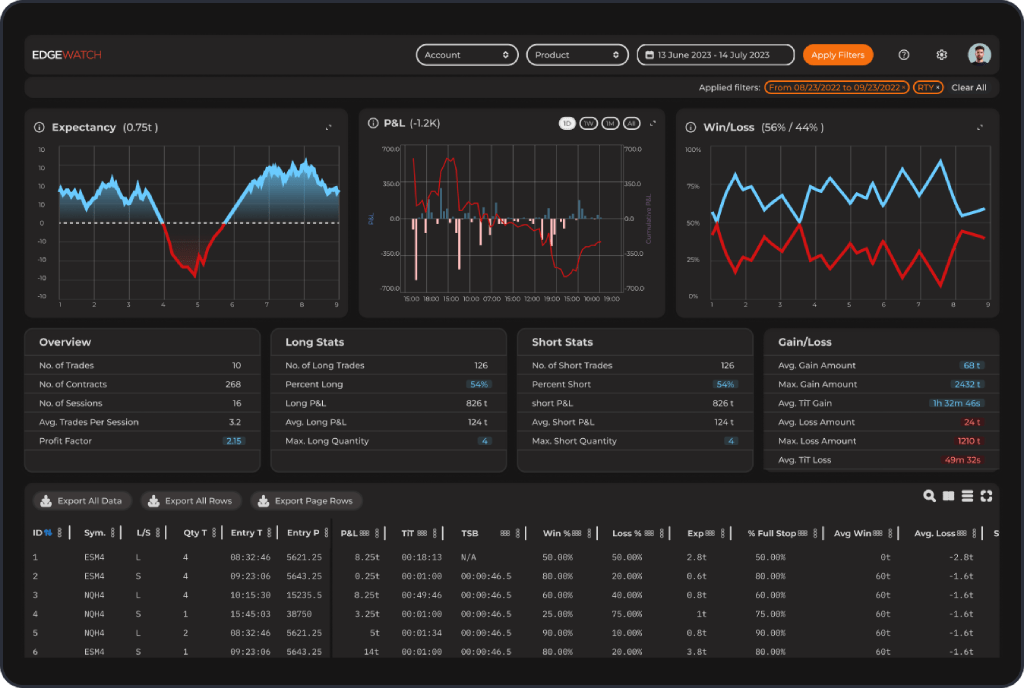

EdgeWatch is a trading analytics platform, developed by EdgeClear, which runs on the Rithmic data feed. It is used by traders to measure all of the information mentioned above, and more. It does this automatically without you having to use third party tools and spreadsheets to import information.

Even better, this cloud-based software is FREE for all EdgeClear clients!

What Metrics Does EdgeWatch Track?

EdgeClear’s newly updated version of EdgeWatch allows traders to view all of the below components for every trade they’ve placed. Advanced filtering also allows you to break down the data by date range, and even products traded.

- Number of Trades Placed

- Number of Contracts Traded

- Number of Sessions Traded in a given date range

- Average Trades per Trading Session

- *Profit Factor

- Average Gain on Winning Trades

- Max Gain on Winning Trades

- Average Loss on Losing Trades

- Max Loss on Losing Trades

- Average Time in Winning Trades

- Average Time in Losing Trades

- *Expectancy

- Profit and Loss

- *Win/Loss Percentage

Why Should You Track this Information?

As stated above, in my opinion, trading without utilizing this information is like running a business without a defined business plan. Without being able to define your trading setups and visually see what your risk/reward ratios are, you are essentially walking to a casino, going to the most expensive slot machine, and spinning the wheel. Inevitably, your emotions will come into play and you may find yourself trading on, what we refer to as, ‘tilt.”

To put this a different way, imagine putting your capital into a fund or giving money to someone who trades and manages capital professionally such as a CTA. What factors are you going to look at before you let someone else control your funds?

First, you’re likely to want to know what their historical track record is. Does the performance of this individual, entity, or manager hold up over time with positive expectancy? How long have they been doing this and what is the sample size?

You’ll also likely want to know what markets they are trading. Do you want to have exposure to certain commodities or indexes that you might deem too risky?

Finally, you may want to know some statistics such as Sharpe, Sortino, or Calmar ratios. How much are they risking with each position they are putting on? What do they generate for this risk?

If these are all factors you may consider when putting your capital with a third party, why not utilize a tool to measure this information for your own trading?

How Can You Use the Data in EdgeWatch to Improve Your Trading?

If you are a new trader, or even if you have been trading for years but never have journaled and viewed your performance through a granular lens, there is no time like the present to start. EdgeWatch provides you a visual breakdown of all of the metrics mentioned.

You can see your Expectancy, Total P/L, and Win/Loss Percentage graphically for easy review.

Metrics that I personally find crucial, are your Average Gains and Losses, as well as Time Spent in those trades.

If you are someone who feels that you have the right read or right trade setups, but simply cannot seem to generate positive expectancy, it could be that you are having a hard time letting go when your trades aren’t working. Alternatively, you may be cutting off winning trades well before you should. This may be due to capital preservation instincts on the gains side, or fear of loss. For losing trades, you may have a hard time admitting you are wrong, or perhaps are risking too much for what you hope to generate in return. EdgeWatch makes it easy to personalize your performance tracking by allowing you to assign a process score to each trade in your trade log.

With customizable filters, you can add additional columns like “Process Score” and “Setup”, giving you deeper insights into your trading performance.

The Process Score can be based on your average score across key dimensions like execution, trade management, and risk management—helping you evaluate not just the outcome of a trade, but how well you followed your process.

Labeling each trade with a setup number and process score helps you stay accountable and consistent, turning your trade log into a powerful tool for improvement.

What Are You Supposed to Do With This Information?

The not-so-exciting part of running a business (yes, we’ve talked ad nauseam in this post about treating trading like a business) is pouring over detailed reports of Cost and Revenue streams, figuring out where you need to focus your growth, and where you need to make potential cuts.

When you’re trading your own self directed strategy, you are the CEO, COO, and CFO.

You need to know and label what specific setups you are taking, break down which setups are working consistently and why. Then break down what is not working, and why. Do you have positive expectancy? Is it better on some setups versus others? Do you have positive expectancy on some markets and not on others?

Is there a psychological barrier that needs to be worked on? Such as, getting greedy (letting trades go so long they turn against you), or getting fearful (cutting trades short).

All of this can be measured and tracked, and the best part is you can export the information from EdgeWatch for even more detailed analysis. If you’re someone who finds emotions creeping into your trading frequently, note the feelings you have after a trade, or after a session.

To wrap up, EdgeClear is incredibly excited to bring this tool to our traders and members, and it’s totally free! We believe journaling and tracking trades is an integral part to becoming a consistent trader. As always, we will continue to innovate and expand on our mission to redefine the trading experience through robust technology and empowering our clients.

If you’d like to learn more and access your free EdgeWatch account, check out the info below to get started.

*Definitions for some of the terms mentioned in this post can be found on our EdgeWatch page.

Disclaimer: The views expressed are personal opinions and should not be interpreted as financial advice.

~ Ian Blanke, Director of Brokerage Services