September 03,2024 @10:50 AM

In the ever-changing world of futures trading, where every contract is a calculated risk on what lies ahead, election seasons add an extra layer of unpredictability. With the next major election quickly approaching, traders are on edge, anticipating market shifts that often follow political shifts. Elections have historically been pivotal for market volatility, sparking volatility across multiple asset classes. My goal is to explore how the upcoming election could impact the futures market, the historical context of election-related volatility, and strategies that traders might employ to navigate this uncertain period from a bipartisan perspective, focusing solely on market dynamics.

The Impact of Elections on Financial Markets

Elections represent a critical inflection point for financial markets, with outcomes often triggering significant shifts in economic policy, regulatory environments, and international relations. These shifts, in turn, influence market sentiment and price movements across various asset classes, including futures (GPS Capital Markets, LLC).

It’s important to note that this analysis approaches the topic from a bipartisan standpoint, focusing on how markets react to uncertainty rather than endorsing any particular political outcome. Both major political parties, regardless of their ideologies, can introduce different forms of economic uncertainty that impact market dynamics (CME Group).

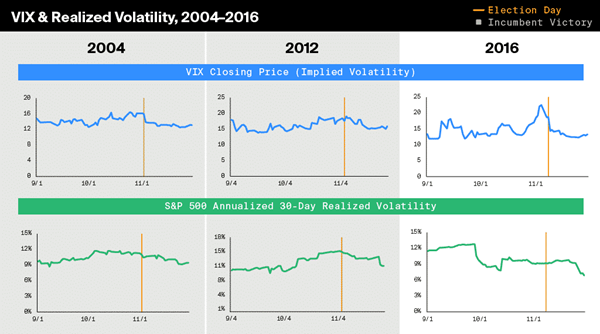

Historically, Election periods often bring increased uncertainty as markets attempt to price in potential outcomes. For instance, U.S. presidential elections have historically heightened volatility in equity markets, which then impacts futures markets. The 2016 election is a notable example, where Donald Trump’s unexpected victory caused sharp movements in stock index futures as markets quickly reassessed economic prospects. However, similar reactions can occur under any administration if the results or anticipated policies are unexpected (CME Group).

Case Studies of Election-Induced Volatility

- 2016 U.S. Presidential Election: The night of the election saw futures for the S&P 500 plunge as much as 5% in the hours following the announcement of Trump’s victory, only to recover and rally the next day. This whipsaw action highlighted how futures markets can react violently to unexpected political outcomes, regardless of the candidate (Economics Observatory).

- Brexit Referendum (2016): Although not a traditional election, the Brexit referendum’s outcome had profound implications for the futures market, particularly in the foreign exchange and commodities sectors. The British pound futures experienced extreme volatility, with the currency plunging to its lowest level in decades against the U.S. dollar. This event illustrates how market volatility can arise from major political decisions, irrespective of party lines (GPS Capital Markets, LLC).

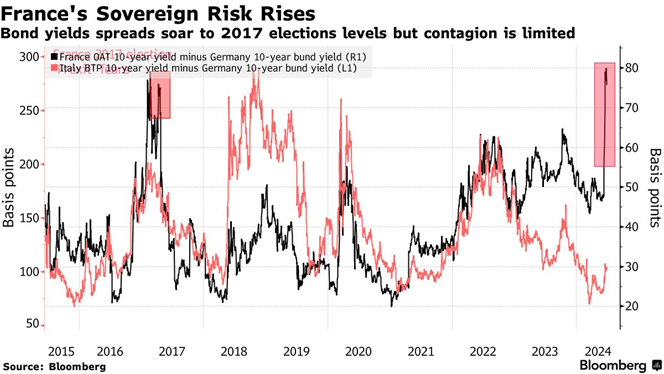

- French Presidential Election (2017): The election of Emmanuel Macron sparked a market-friendly outcome, driving a rally in European equity futures. However, the lead-up to the election was fraught with uncertainty, particularly with the possibility of a Marine Le Pen victory, which could have led to significant disruptions in the European Union and global markets. This scenario underscores that market reactions are driven by uncertainty rather than political affiliation (Macro Hive).

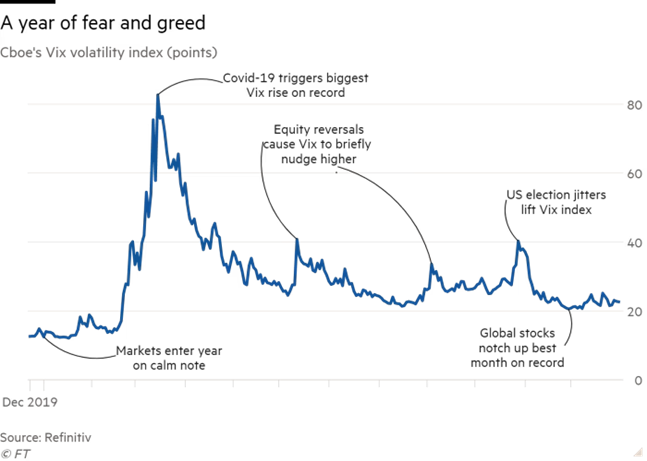

- 2020 U.S. Presidential Election: The lead-up to the 2020 election saw significant volatility in the futures market due to heightened uncertainty. The VIX Index, a key measure of market volatility, spiked as investors feared a contested election and the potential for significant policy shifts depending on the outcome. On election night, futures markets experienced sharp fluctuations as results were delayed in key battleground states. The eventual declaration of Joe Biden as the winner led to some stabilization, but concerns over legal challenges and the Georgia Senate runoff kept markets on edge, highlighting how political uncertainty can drive futures volatility.

My aim in providing these examples is to highlight historical elections that have significantly influenced futures market volatility. I anticipate potential volatility in the upcoming election, although it’s important to remember that past events don’t necessarily predict future outcomes.

Key Factors Contributing to Volatility

Policy Uncertainty: Market volatility during elections often stems from policy uncertainty. Political parties typically have differing economic agendas, especially regarding fiscal policy, trade, taxation, and regulation. For example, a candidate favoring protectionist trade policies could spark fears of a trade war, impacting commodity futures like crude oil or agricultural products. Even with an open trade stance, uncertainty remains a key factor regardless of party or policy (Macro Hive).

Economic Indicators and Central Bank Policy: Elections can shift expectations around central bank policy, closely monitored by futures traders. For instance, if a government is expected to implement aggressive fiscal stimulus, this could raise inflation expectations, prompting the central bank to hike interest rates. This can affect interest rate futures, currency futures, and even commodities like gold, often seen as an inflation hedge. The key focus remains on market reactions to potential policy shifts rather than the policies themselves (GPS Capital Markets, LLC).

Geopolitical Risk: Geopolitical risk is crucial during election periods, especially when outcomes might lead to significant foreign policy changes. Futures markets, particularly in commodities, are sensitive to these risks as they can disrupt global trade and supply chains. Potential shifts in relations between major economies can also heighten volatility in currency futures and bond markets. The analysis remains focused on market impacts rather than political positions, ensuring a bipartisan perspective (Economics Observatory, Macro Hive).

Strategies for Navigating Election-Induced Volatility

1. Hedging with Options

One of the most common strategies employed by futures traders during election periods is hedging with options. Options provide the right, but not the obligation, to buy or sell a futures contract at a predetermined price. By purchasing put options, traders can protect themselves against downside risk if the market moves against them. Conversely, call options can be used to capitalize on potential upside while limiting risk. This is useful regardless of the political party expected to win, as the underlying concern is market volatility (CME Group). However, it’s important to address that options on futures carry significant risk due to the already high leverage that is present, which can amplify both gains and losses.

2. Diversification

Diversification is another critical strategy. By spreading exposure across different asset classes and geographical regions, traders can reduce risk associated with any single election outcome. For example, holding equity index futures, commodity futures, and currency futures can mitigate the impact of volatility. This approach is apolitical and focuses solely on risk management (Stash).

3. Staying Liquid

During periods of heightened uncertainty, maintaining liquidity is crucial. Traders should consider reducing their position sizes to manage risk better and avoid being caught in adverse market moves. Staying liquid allows traders to react more quickly to new information and adjust their strategies as election results unfold. This is a strategy that applies to all market conditions, regardless of political context (GPS Capital Markets, LLC).

4. Monitoring Economic Indicators

Traders should pay attention to economic indicators before an election, as these can provide clues about the potential policy direction of candidates. For example, strong employment numbers might bolster a candidate’s chances, impacting expectations around fiscal and monetary policy. Monitoring indicators can help traders position themselves effectively within futures markets, without taking a political stance (GPS Capital Markets, LLC).

5. Leveraging Market Sentiment Indicators

Market sentiment indicators, like VIX (Volatility Index), can provide valuable insights into the level of uncertainty in the market. A rising VIX, often referred to as the “fear gauge,” suggests that traders are expecting higher volatility. Futures traders can use this information to adjust their strategies, perhaps by increasing hedging or reducing exposure to volatile markets. This approach is focused purely on market behavior, irrespective of political considerations (Macro Hive).

The upcoming election represents a pivotal moment for futures markets, with potential to drive substantial volatility across various asset classes. Drawing from historical examples, it’s clear that elections can act as catalysts for market movements. This is driven by policy uncertainty, economic indicators, and geopolitical risks. Traders who prepare by employing strategies like hedging, diversification, and staying liquid can allow for better positioning to navigate these fluctuations. Approaching this period with an unbiased focus on market dynamics rather than political affiliations may turn uncertainty into opportunity.

How EdgeClear Can Help

At EdgeClear, we understand how overwhelming it can be to navigate market volatility, especially during election periods. Our team is here to help—from our cutting-edge technology, custom solutions, and our client-focused support. Check out some of our services and technology below.

EdgeProX — Our trading platform, EdgeProX, offers low-latency execution and advanced algorithmic trading capabilities. It integrates real-time data feeds and analytics for vital insights into current market trends. Some of its key features include unique customization preferences, risk management tools, and trade simulations; all designed to empower traders to adapt quickly and effectively.

EdgeWatch — EdgeWatch is a powerful Rithmic plug-in that can enhance your trades with real-time market monitoring and analytics. The plug-in offers customizable alerts, real-time and historical performance metrics, and market data to help you stay ahead of election-season volatility.

Platinum Services — With market volatility on the rise due to election season, our Platinum Services offer a competitive edge for traders navigating market turbulence. Our premier suite provides personalized strategy development, where traders collaborate with experts to tailor their trading plan to market conditions. With priority support, our team ensures that you will receive prompt assistance whenever it’s needed. These services also include custom technology solutions and bespoke trading setups, designed to optimize performance during high market volatility.

How do you think the coming elections will affect markets? Reach out to me at the contact form below or my LinkedIn with your thoughts.

Disclaimer: Derivatives trading involves a substantial risk of loss and is not suitable for all investors. Past Performance is not necessarily indicative of future results. Opinions expressed are solely their own opinions and do not reflect the opinions of EdgeClear.

~ Giancarlo Saraceno, Senior Commodities Broker