Quantower

Request a Rithmic Demo

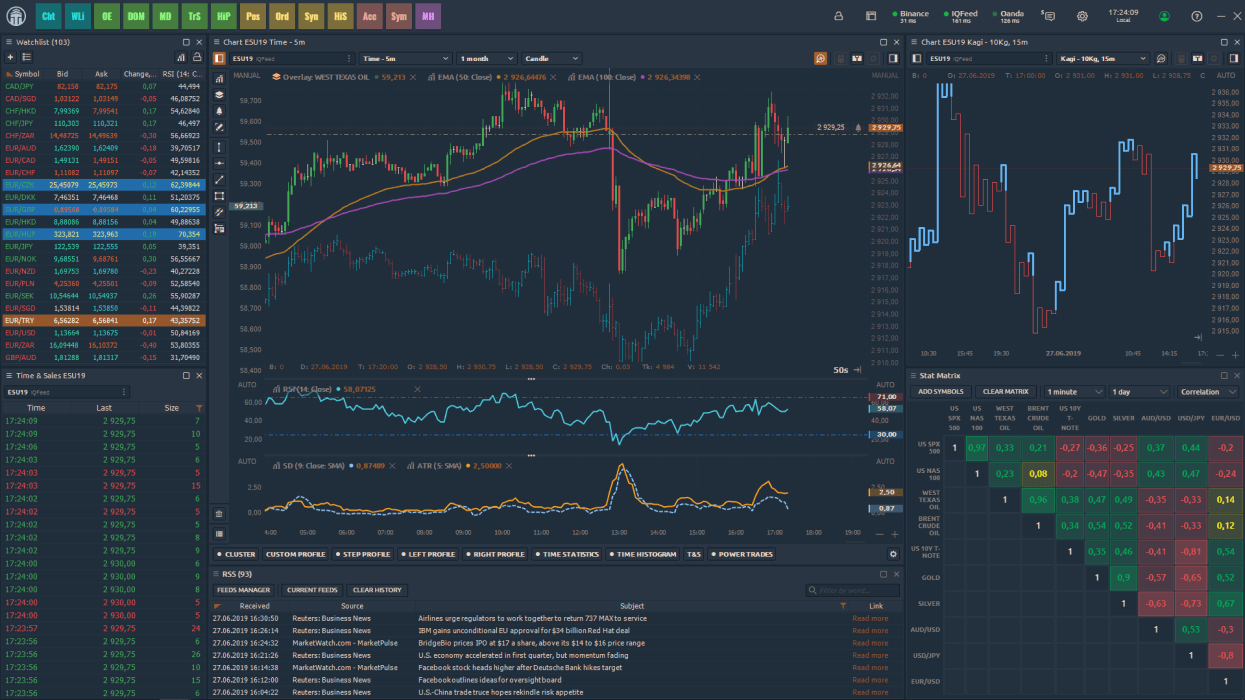

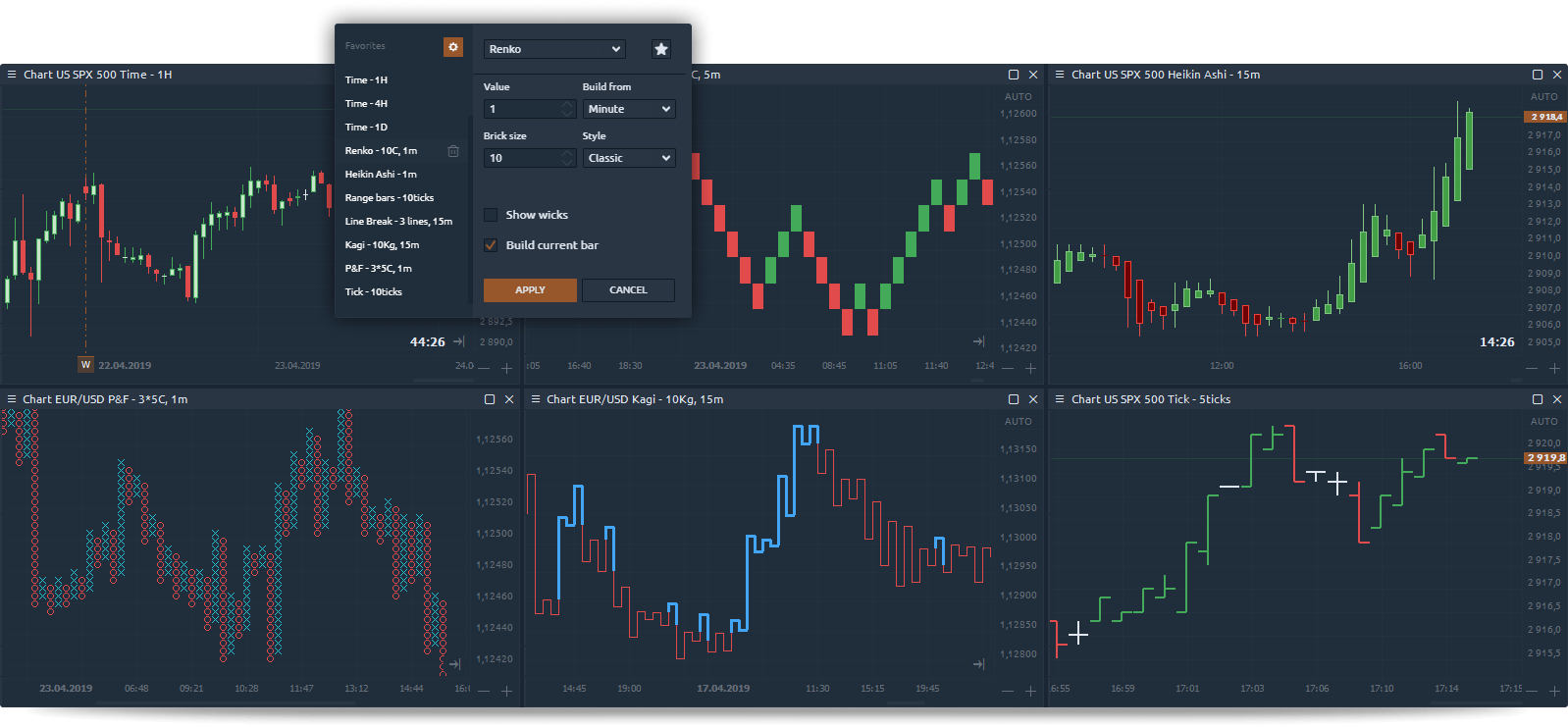

Charts

Get a trading advantage in the market using professional charting tools. Analyze the market with our easy-to-use features and an extensive list of chart types:

- Kagi, Renko, Point & Figure, Line Break

- Time-based chart with custom time periods

- Heiken-Ashi, Tick chart, Range Bars

The Depth & Sales is also your primary order entry tool, with one click trading, automated exit strategies, auto order types, volume-based stops, and the overall feel of an execution tool that could only have been developed by a fellow trader.

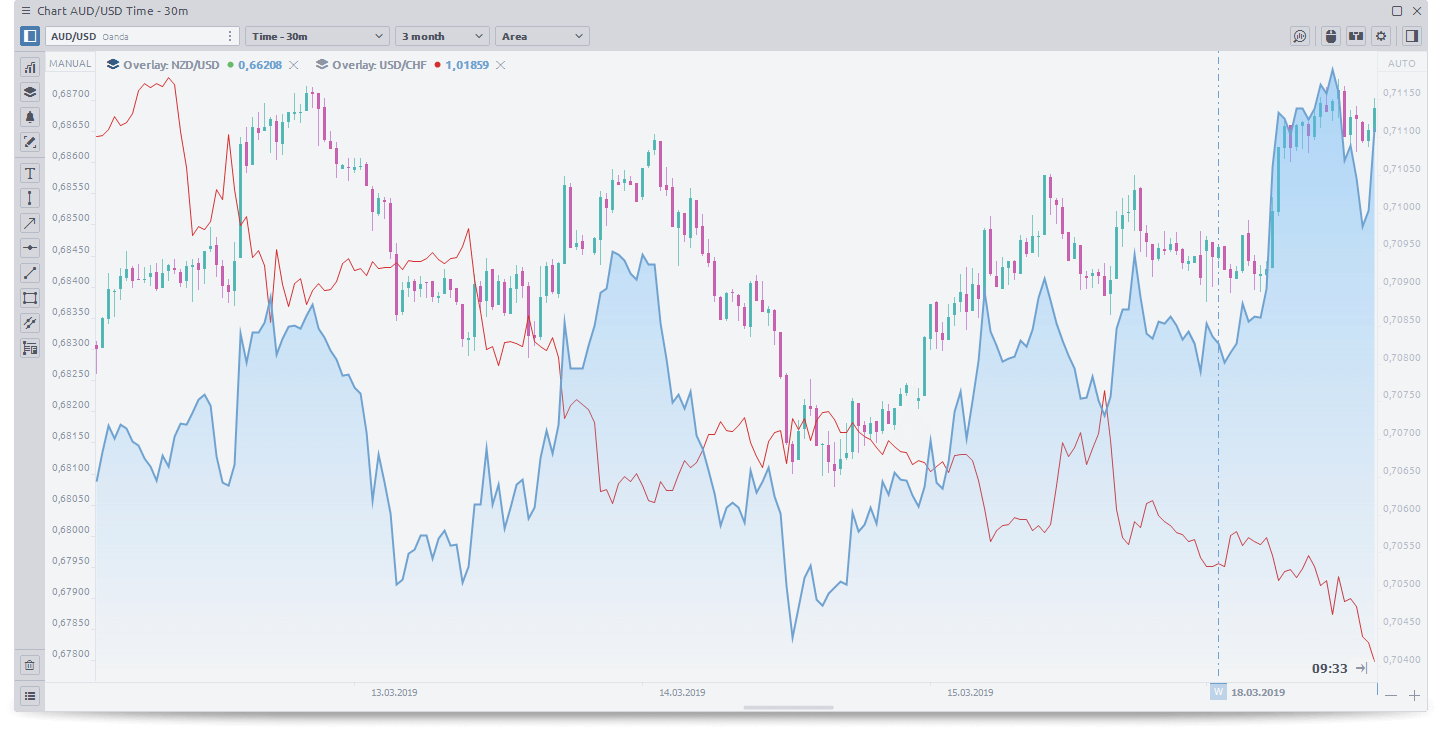

Chart overlays

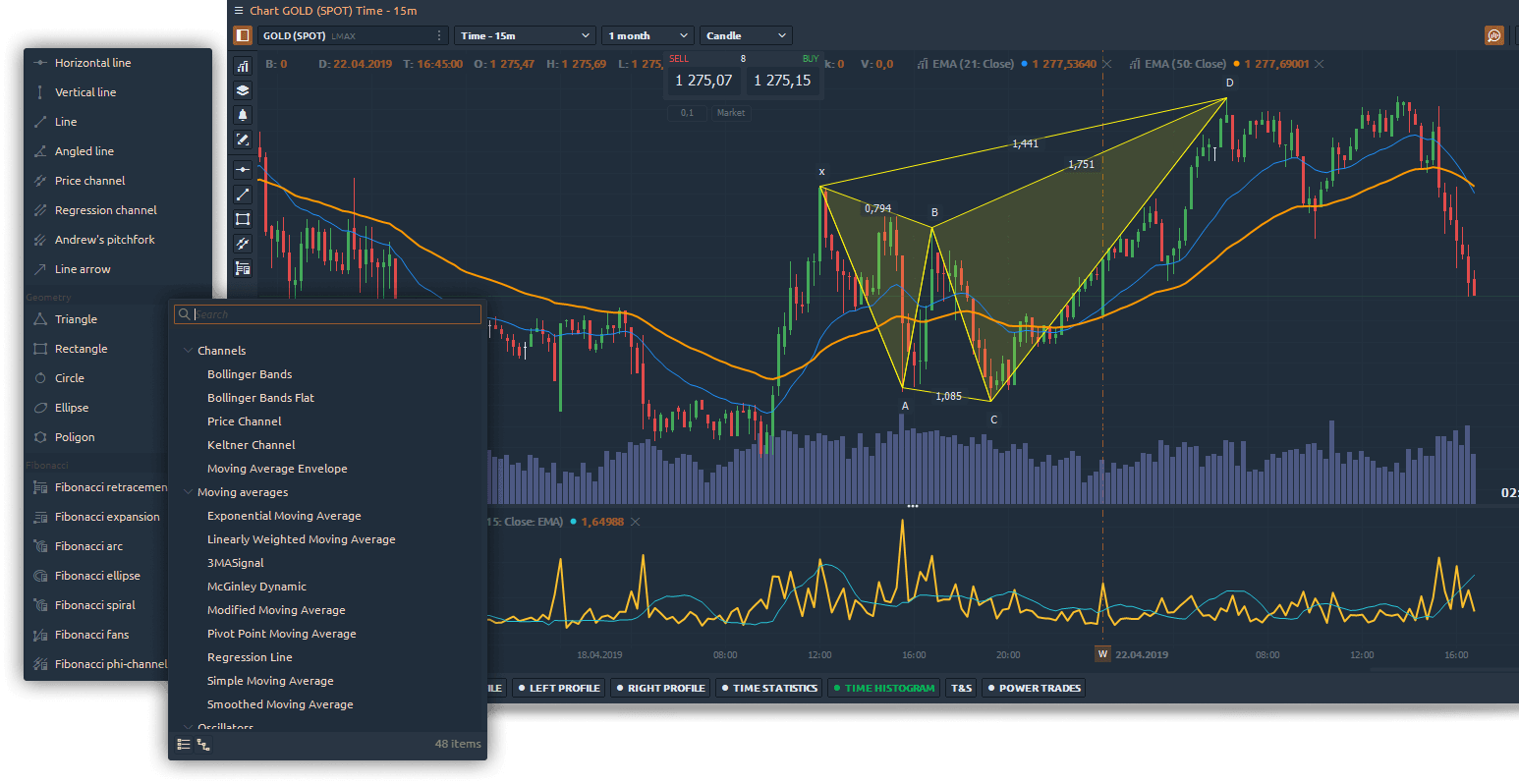

Drawings and indicators

Wide list of drawing tools and indicators are ideal for technical traders to analyze volatility, support & resistance, trends, as well as reversal points.

- Trends & Channels

- Geometry tools

- Fibonacci & Gann

- Harmonic patterns

- Text & Comments

- Channels

- Moving Averages

- Trends Volatility

- Volume

- Oscillators

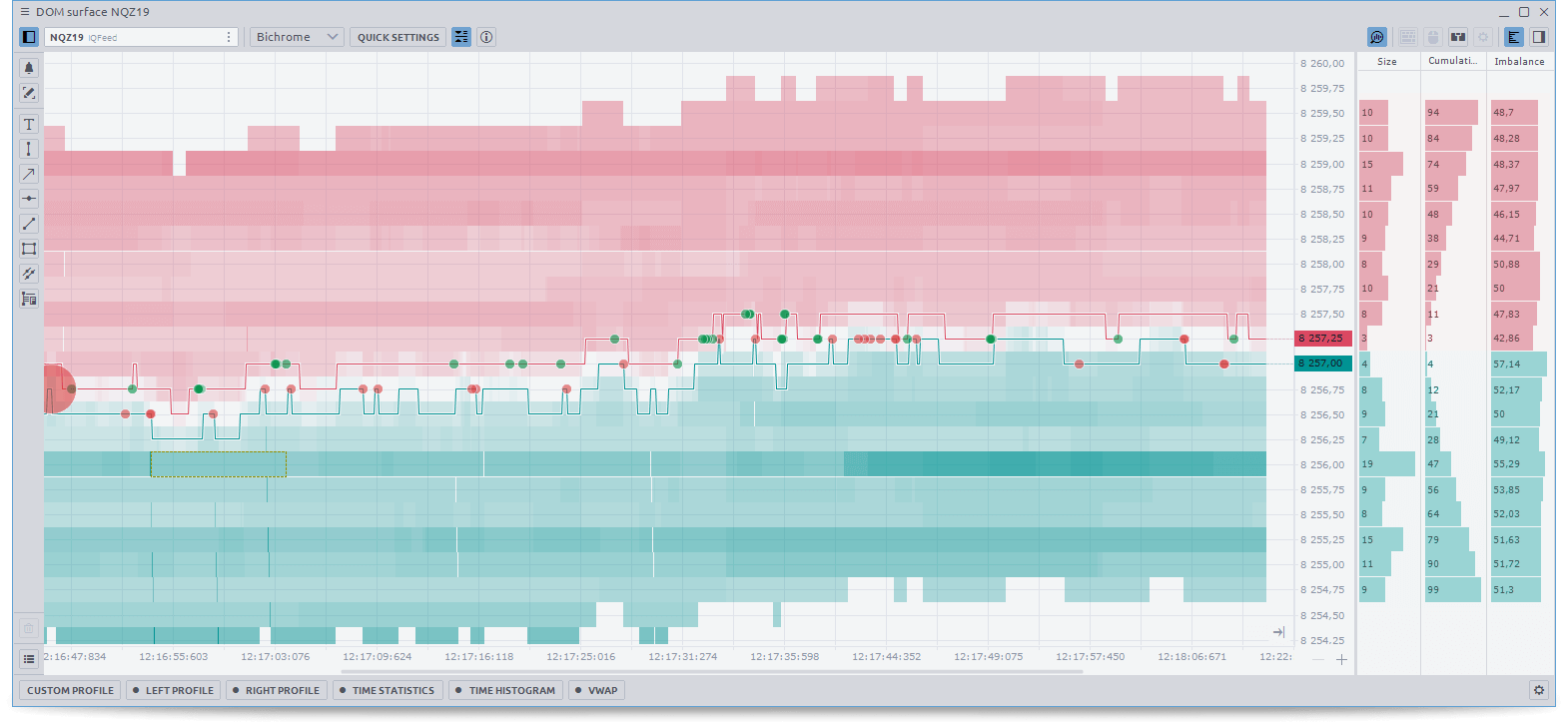

Order flow surface

Gain unique market insight by using Order Flow Surface. Find the most reliable price levels with a huge amount of limit orders that can affect the price movement

- Analyze Cryptocurrencies, Futures, Stocks, ETFs

- Use Volume Analysis Tools directly on the order flow chart

- Set different numbers of DOM levels for a clear picture

- Heatmap mode tracks the liquidity change at each price level

Volume analysis tools

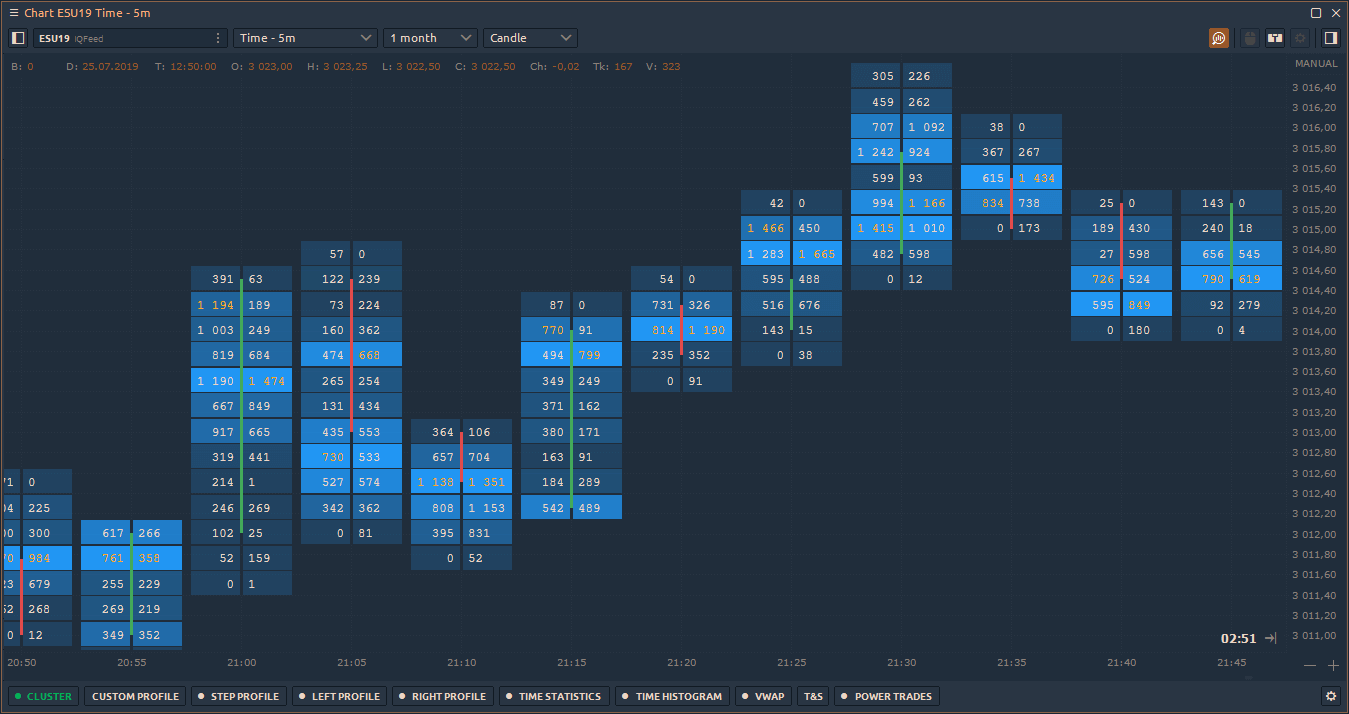

Cluster Chart:

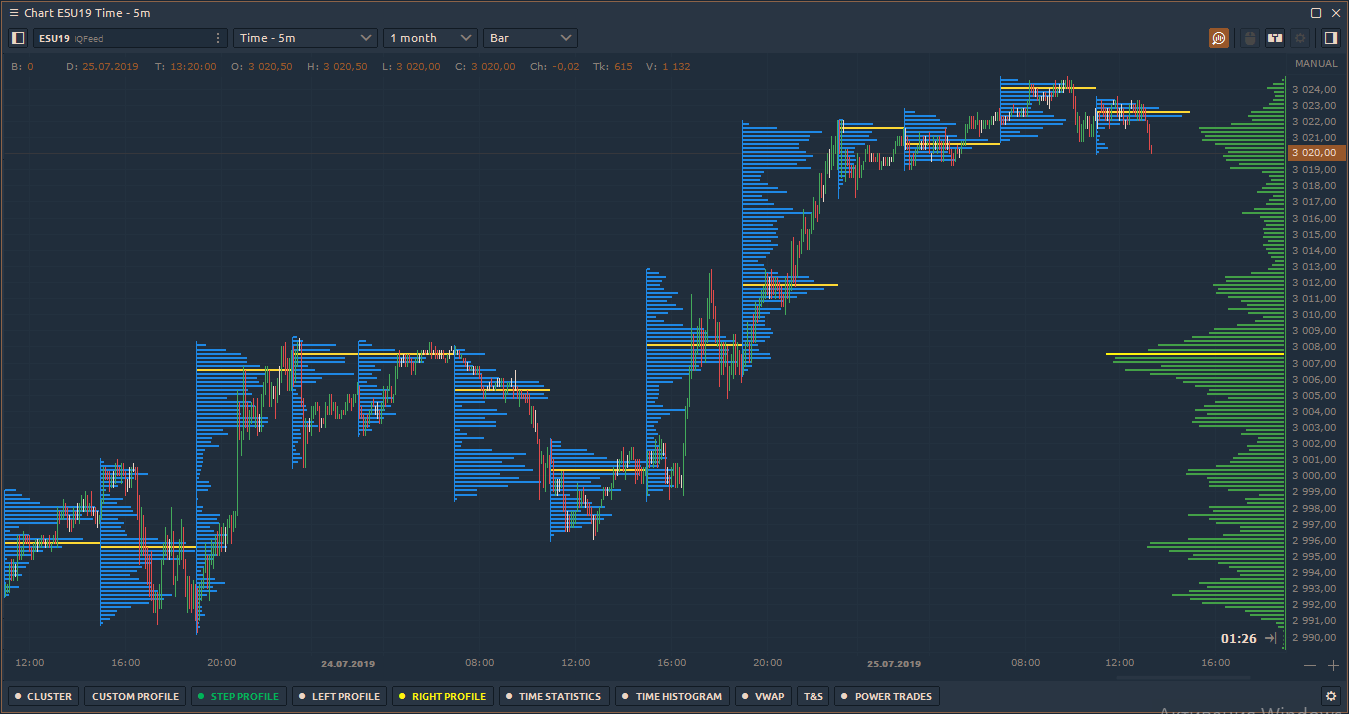

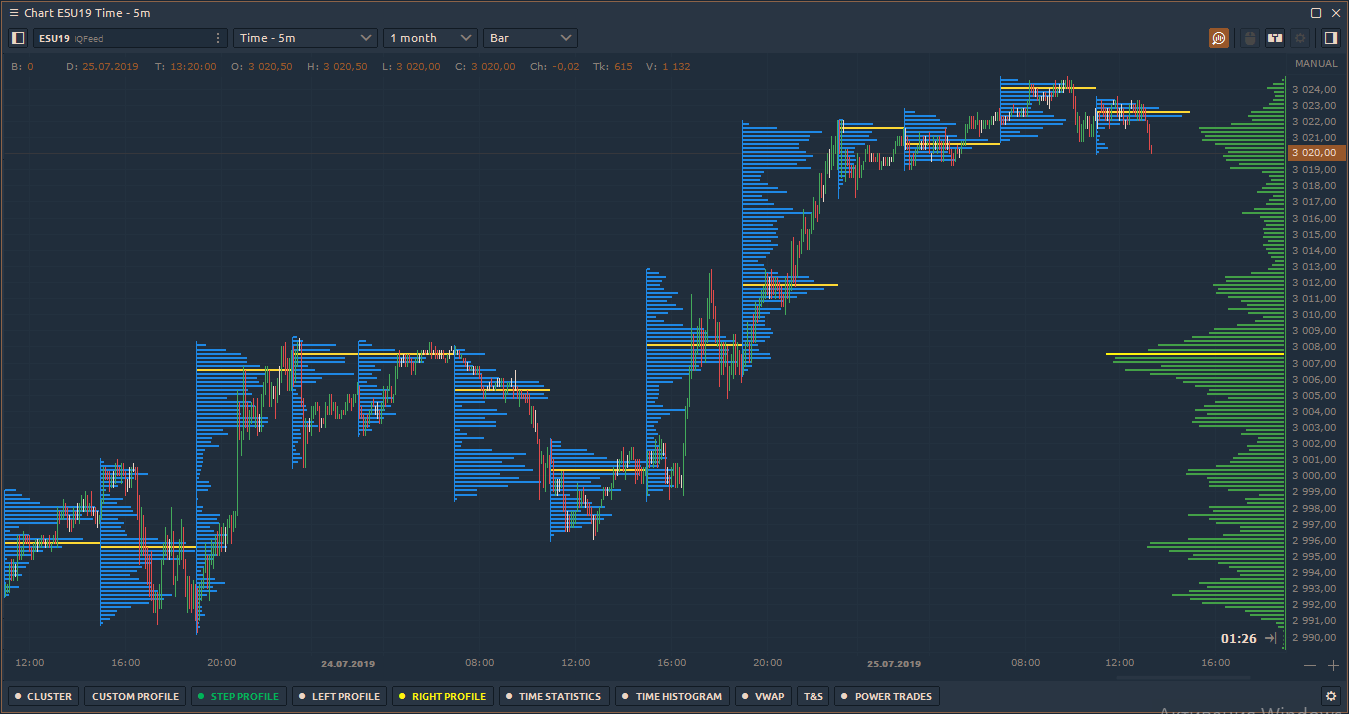

Volume Profile:

Historical Time and Sales:

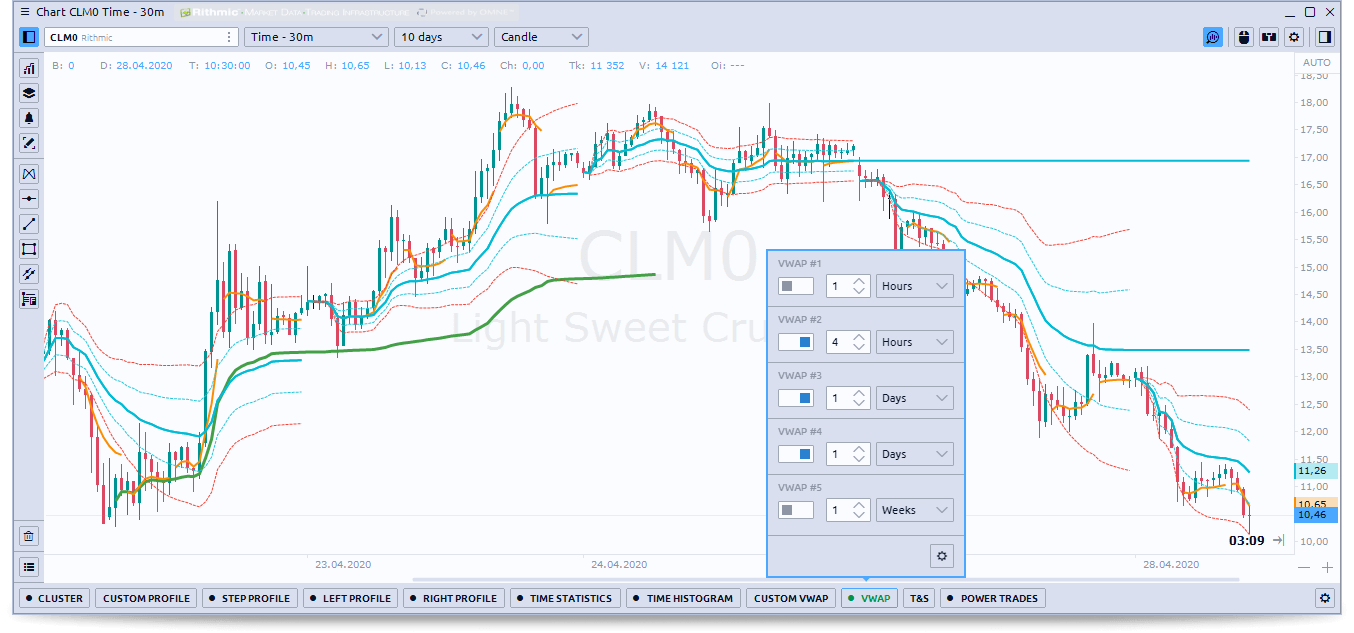

Volume weighted average price (VWAP)

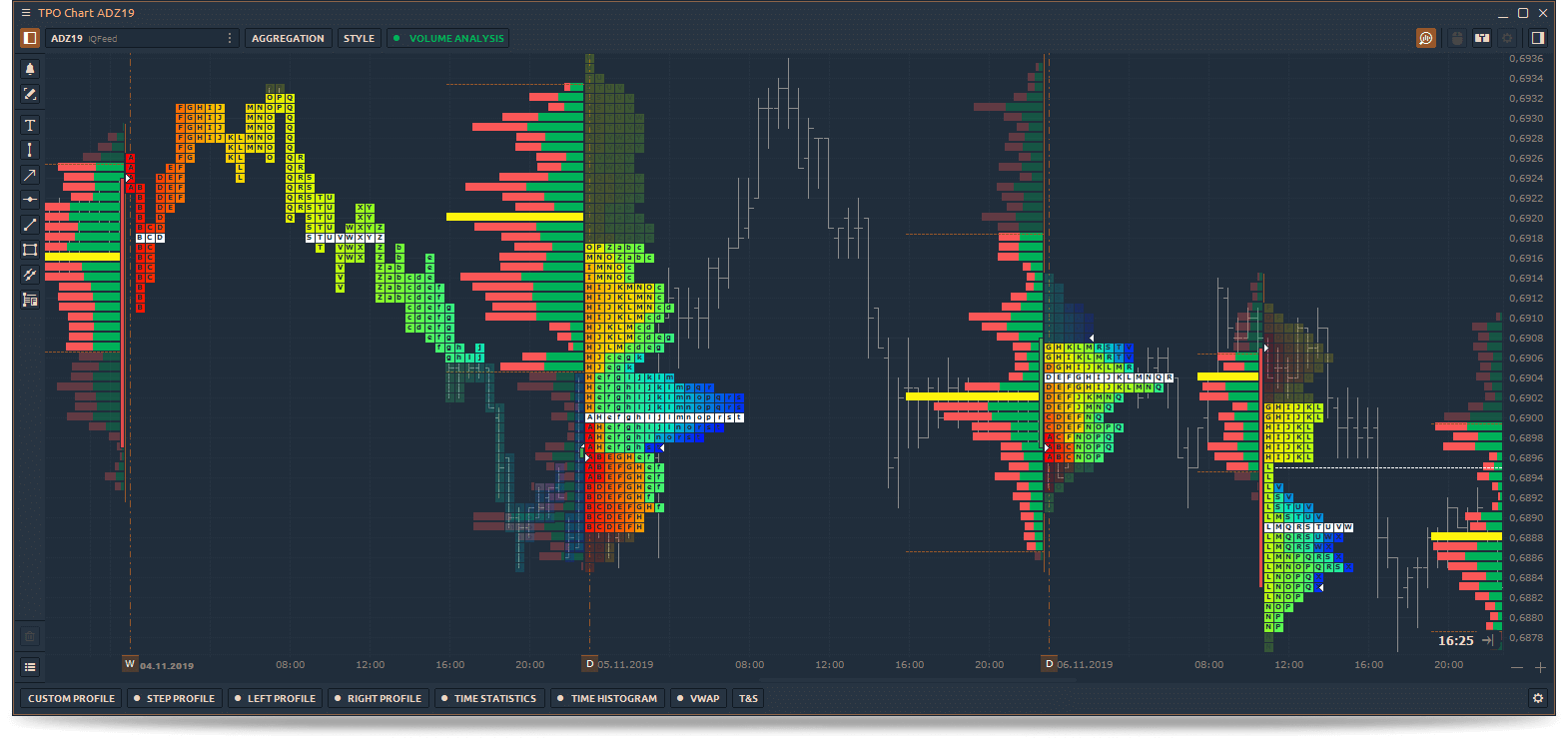

TPO profile chart

Analyze the TPO Profile to understand the price distribution during the day or trading session

- Shows crucial support/resistance price levels

- Display TPO Point of Control, Value Area and Singles

- Split & Merge TPO Profiles for all-around analysis