October 11,2024 @11:52 AM

Navigating the futures markets calls for more than just a basic understanding of trading principles. It requires a deep dive into sophisticated strategies that set you apart from the crowd. Think of futures trading as a physical marketplace where every trader is a vendor with their own strategy and perspective. Within this busy market, advanced traders are akin to seasoned vendors that not only know their product inside and out, but also the ebb and flow of the market as a whole.

Within this piece, we will dive into the deeper mechanics of the futures marketplace. Just as a savvy vendor adjusts their approach based on the latest market trends and customer behavior, you’ll learn to refine your strategies, anticipate shifts, and make more well-informed decisions in the futures space.

Utilizing Technical Analysis for Futures Trading

As a trader becomes more acquainted within futures, technical analysis becomes a much more critical tool. Technical analysis can involve studying price charts, identifying trends, and finding key support and resistance levels. Traders can use these insights to anticipate future price movements and improve their entry and exit strategies.

Many traders that have long-term profitability have the ability to spot both short-term opportunities and long-term trends. No matter what kind of commodities you’re trading, technical analysis can help to develop a structured approach to your trades. However, it is important to note that although technical analysis can be a helpful tool, it is not fool-proof. A trader should utilize technical analysis alongside other advanced strategies and adjust accordingly to market conditions. Below, we are going to unpack several core principles that advanced trader’s should understand and utilize.

Auction Market Theory: The Foundation of Futures Market Movement

Auction Market Theory works as the foundation for understanding how futures markets operate. This theory notes that every transaction within an exchange involves a buyer and a seller. Prices fluctuate depending on the interaction between supply and demand. When demand rises above supply at a given price, prices move upward, and when supply exceeds demand, prices fall. Buyers and sellers utilize market orders when lifting the offer or hitting the bid to transact at the current best bid or ask price, creating a movement in either side. Resting bids and offers do not move markets. These are also known as resting limit orders. While these do not directly move the market, they can influence market behavior by creating levels of support or resistance, and by absorbing aggressive orders, they can prevent price movements temporarily.

In the dynamic futures industry, markets are constantly in an ever-changing switch between balance and imbalance. Balance refers to when buyers and sellers agree on a price level, leading to stability or ranging markets. On the other hand, imbalance happens when one side becomes more aggressive, pushing prices in a particular direction. This imbalance creates the trends that traders follow today in futures.

Why Is This Important?

Understanding Auction Market Theory is vital for traders, as it emphasizes the importance of current market behavior over expectations. Markets are forward-looking and assets are repriced based on new information, reflecting the expectations of market participants. To capitalize on market movements, traders should understand when the market is imbalanced verses when it is balanced. This understanding will help traders to time their entries and exits. Long-term profitability within futures trading involves staying grounded in current market conditions, rather than solely relying on future shifts.

Efficient Markets Hypothesis: Efficiency and Opportunities

The Efficient Markets Hypothesis helps to explain how futures markets incorporate all available information into prices, highlighting opportunities for well-informed traders. Efficient market Hypothesis comes in three forms—weak, semi-strong, and strong—each describing different levels of market efficiency.

- Weak Form Efficiency — Within this level there is a lack of predictability. Weak form efficiency notes that historical prices and volumes are reflected within current asset prices. This means that solely relying on technical analysis pertaining to historical prices wouldn’t give traders an advantage in predicting future price movements.

- What does this mean for traders?

- If a market is weak form efficient, technical analysis techniques, like chart patterns, are less likely to bring consistent profits. All historical price information is already embedded within the current market price, so any potential gains are already realized.

- In this level of market efficiency, traders should look towards other forms of analysis to find an edge. One form is fundamental analysis, in which traders evaluate economic indicators, financial statements, industry trends, and other data that could impact the value of an asset. Overall, advanced traders should expand their trading strategies so they don’t heavily rely on only past price data, especially in the case of the market being weak form efficient.

- If a market is weak form efficient, technical analysis techniques, like chart patterns, are less likely to bring consistent profits. All historical price information is already embedded within the current market price, so any potential gains are already realized.

- What does this mean for traders?

- Semi-Strong Form Efficiency — Semi-strong form efficiency asserts that current asset prices fully reflect all publicly available information, including historical data and any public news. Reacting quickly to financial news rarely leads to stellar returns, as the market has already priced in the information.

- What does this mean for traders?

- In a semi-strong efficient market, only reacting to market news or public information won’t result in consistent profits.

- Instead, traders should center their focus on developing strategies that go beyond publicly available data. This could include seeking insights through alternative data sources not appreciated by the broader market. Traders can also look to uncover less obvious trends to find an edge to their trades.

- In a semi-strong efficient market, only reacting to market news or public information won’t result in consistent profits.

- What does this mean for traders?

- Strong Form Efficiency — Strong form efficiency asserts that current asset prices fully reflect all information—public or private This means that no one, even those with insider information, can profit from this information. This theoretical concept doesn’t reflect the true nature of actual futures markets. In reality, markets have never achieved true strong form efficiency.

So, how can you apply this information to your trades?

While the Efficient Markets Hypothesis notes that markets incorporate market information efficiently, there are still inefficiencies to consider. Markets cannot always react instantaneously to new data, leaving opportunities for traders to take advantage of. Having an understanding of the different levels of market efficiency may help you to spot key opportunities. By identifying areas with information gaps and acting quickly and strategically, traders can take advantage of these opportunities.

The True Nature of Markets: More Than Just Price, Time, and Volume

A fault that many traders have is simply fixating on just price, time, and volume without understanding the factors that drive market movements. However, true success in futures calls for recognizing price movements without simply relying on surface-level indicators. Markets move based on the collective psyche of its participants. This can amplify fear, greed, and many other human emotions that are embedded into a trader’s work behind the screens. Just as a traveler in the desert might chase mirages, traders can easily fall into the trap of following “holy grail” systems. This is why it is paramount for traders to have a pure understanding of the nature of markets, aside from just outcomes.

Even advanced algorithms that are built to trade markets don’t always win because markets, by nature, are probabilistic. Market participants transact within markets on different timeframes for different reasons. Our job is not to gauge why an individual buyer or seller is transacting, rather to view the collective actions of buyers and sellers to gain an understanding of supply and demand dynamics.

This is only a brief explanation about the true nature of markets. Many lengthy books and courses have been written about this subject, while the majority fail to discuss the true reality of markets. While what I am writing isn’t new or revolutionary, it is a direct view into my industry exposure and guidance from expert traders within the space.

Trading Strategies

Now that you have a stronger understanding of technical analysis and the nature of the industry, let’s dive into some trading strategies! But before diving into specific strategies, it’s essential to establish a process for analyzing the markets and deciding when to apply a strategy, or when to wait on the sidelines for the right opportunity.

Big Picture

When I begin my day, I look at my charts and write out my “Big Picture” for the markets. To start, I ask myself four questions that were often mentioned within FT71’s Trader Bite series:

- What has the market done?

- What is it trying to do?

- How good of a job is it doing?

- What is more likely to happen from here?

To answer these questions, I begin by looking at the Monthly, Weekly, and Daily timeframes to uncover if the market is trending or ranging. Price charts with candlesticks provide a basic view, but I also utilize Composite Volume Profiles (e.g. Volume Profile YTD) and Micro Composites to identify areas of balance and imbalance. Volume data provides an extra layer of insight to where most trading activity has occurred, indicating balance, and where less volume has occurred, indicating imbalance.

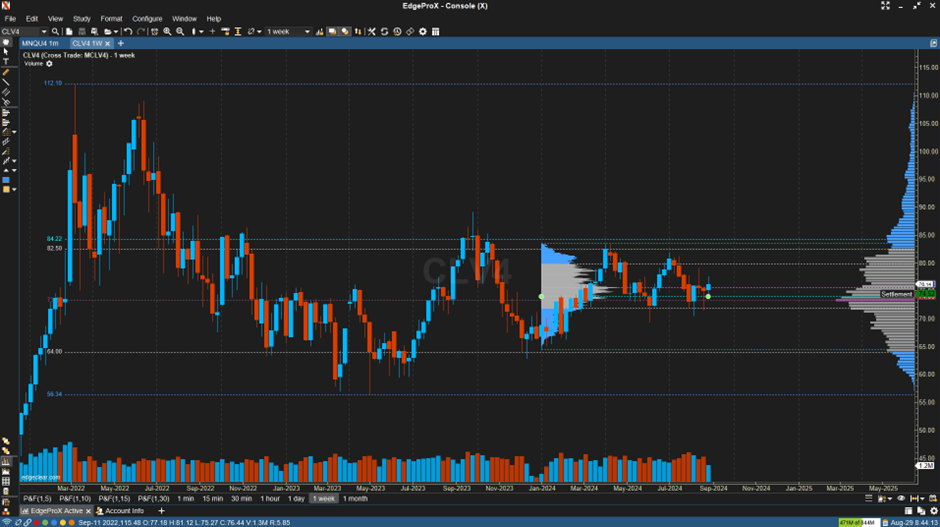

An example of Big Picture analysis is my analysis of Crude Oil NYMEX WTI futures contracts. Refer to the image below:

We can see that since the 2022 high and low, a value area has formed in the Composite Volume Profile shaded in grey on the right. Additionally, the 2024 Composite Volume Profile is contained within this larger value area, failing to break from the 2022 mid-range. Throughout most of 2024, the market has been between the 82-72 range.

This big picture analysis suggests that in a ranging market, fading the extremes is a sensible strategy until there is a visible shift in market sentiment. We also identify a “chop zone” where two CVPOCs and the 2024 mid-range align. This is my no-trade zone—an area to avoid in current market conditions.

Within this analysis, we’ve addressed the second and third questions:

- What is the market trying to do?

- How well is it doing?

The fourth question, “What is more likely to happen from here?” guides us in crafting scenarios, forming our trade plan. Once the scenarios are established and the market analysis is complete, I map them out on a 1-hour or 30-minute timeframe, where I monitor my trade setups. For execution, I go down to a 5-minute timeframe, allowing for multiple timeframe confluence to gauge market direction. On the execution timeframe, I wait for the trigger that matches my trade setup and execute.

Now that you have seen an example in action, here’s the components of a trading strategy:

- Market Analysis

- Trade Plan

- Trade Setup

- Risk Management Plan

- Execution

- Trade Management

While all of these elements are crucial, in my opinion, the most vital components are risk management, execution, and trade management. These are three pillars that help traders move toward their goal of becoming consistently profitable. It is important to note that this is an ever-changing process. The true edge lies in the trader’s ability to follow the process, not just the trade setup alone.

Risk Management

Risk management is an important part of staying in the futures game and gaining the necessary experience to succeed long term. One of the biggest pain points that traders face is the itch to get rich quickly—what I call “myopia” and “tunnel vision”. Many retail traders fall into the trap of focusing on the next trade rather than the next 1,000 trades. By focusing on the next trade, you are fixated on the profit and loss. In contrast, proper risk management is about knowing the mathematics of survival in the market, preserving capital, and taking enough calculated risks to let your edge play out.

Trading Psychology

Another large component of your edge is trading psychology. To truly grow as a trader, you must experience this firsthand by executing and following your trade play day in and day out. Profits and losses are secondary. A streak of losses can affect your mindset, but sticking to your process helps maintain strong trading psychology.

This is a significant topic that could be explored in much greater depth, but as promised, let’s focus on some trade setups that are straightforward to execute.

Trade Setups, Management, and Execution

For our trade setups, trade management, and execution, we consider the following key metric:

Expectancy = (%Win * Avg. Win) – (% Loss * Avg. Loss)

Given your capital, assess your risk/reward ratio before entering a trade, and measure the actual risk/reward captured when you exit the trade. Remember, risk-reward is dynamic because markets are inherently random, and it evolves over time. However, this doesn’t mean that you should constantly tweak your execution or trade management.

For novice futures traders, a good approach is to be mechanical with trade execution and trade management. Set both stops and targets using OCO brackets when executing a trade, and let the trade play out. Analyze the results of your first 50 trades, journal them, and determine if any adjustments are needed as you go. Continue this process, journaling for the next 50 trades, and so on, until you achieve positive expectancy.

It’s important to understand that we are not aiming for perfection. Perfection in futures trading doesn’t exist, especially in discretionary or mechanical trading. The markets are random. Our goal is to follow a consistent process in this environment, layering in setups that provide us with an edge.

Trade Setups

Below I am going to share intra-day trading strategies, specifically day trading strategies. With these strategies, I either scalp or hold positions with the intention to exit before the exchange closes if the market structure presents an opportunity. It’s important to note that analyzing trade setups in hindsight is easy, but identifying a trade setup and executing the plan in real-time is where the challenge lies. However, these are setups that I have mostly stuck to as they are straightforward and provide me with an intraday bias that I can align with across multiple timeframes.

1. Pullback/Hold Above/Below VWAP

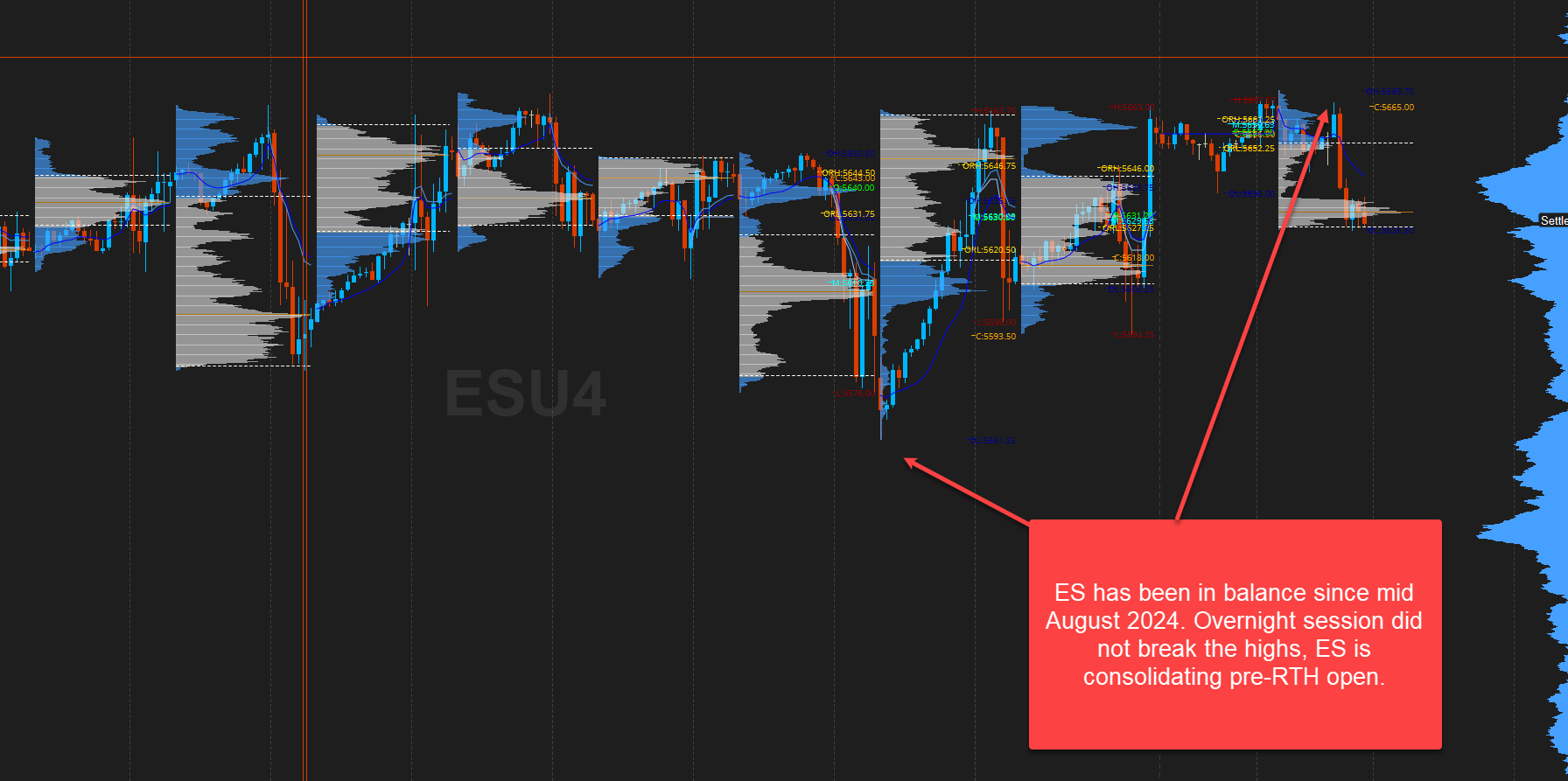

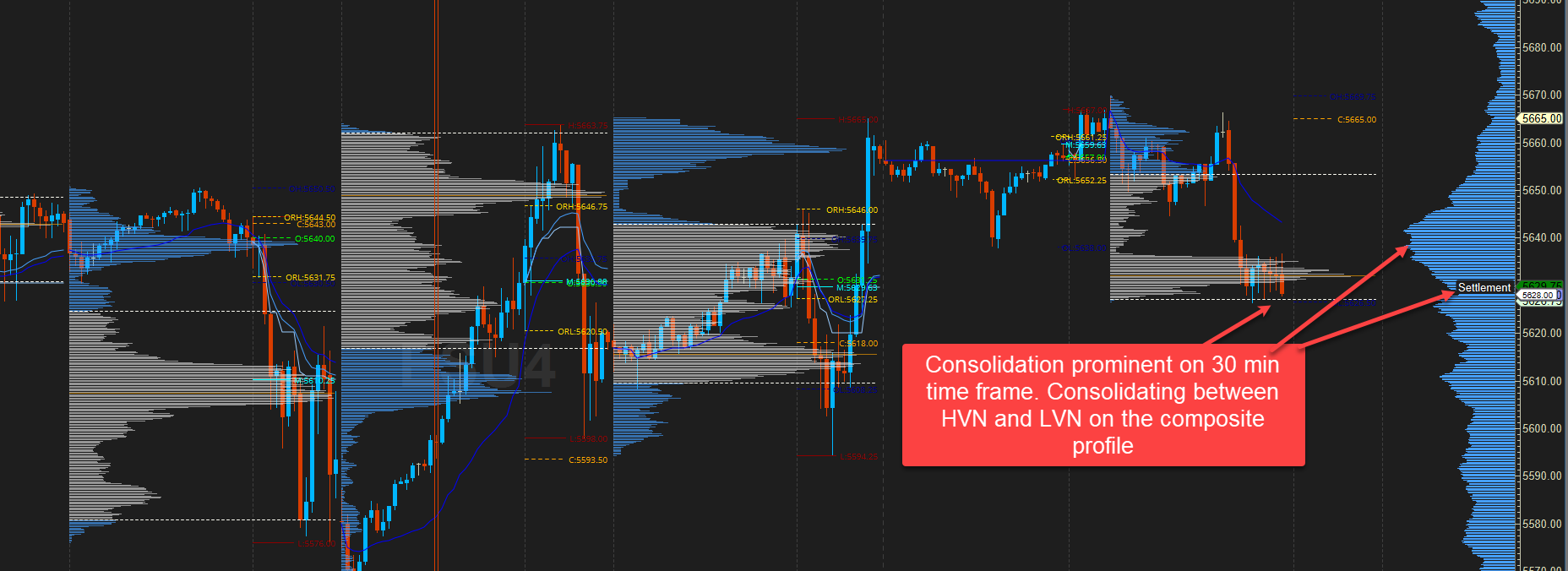

On a higher timeframe, the ES is in balance, though intraday trends within this balance are visible, as shown in the image below.

See further context and details in image below:

In the video below, you can see this trade play out on execution time frame:

Past performance is not indicative of future results

For trade management, it is crucial to monitor the trade on a 30-minute or 1-hour time frame and let the trade play out. Only more advanced traders should consider scratching trades. Scratching trades at break even or small loss is risky, as it can result in a lot of errors and indecision, especially for new traders. I recommend journaling trades with mechanical trade management to build experience and confidence. Your risk should be small enough for you to preserve your capital, and your risk-reward ratio should be sufficient to maintain an edge and favorable long-term expectancy.

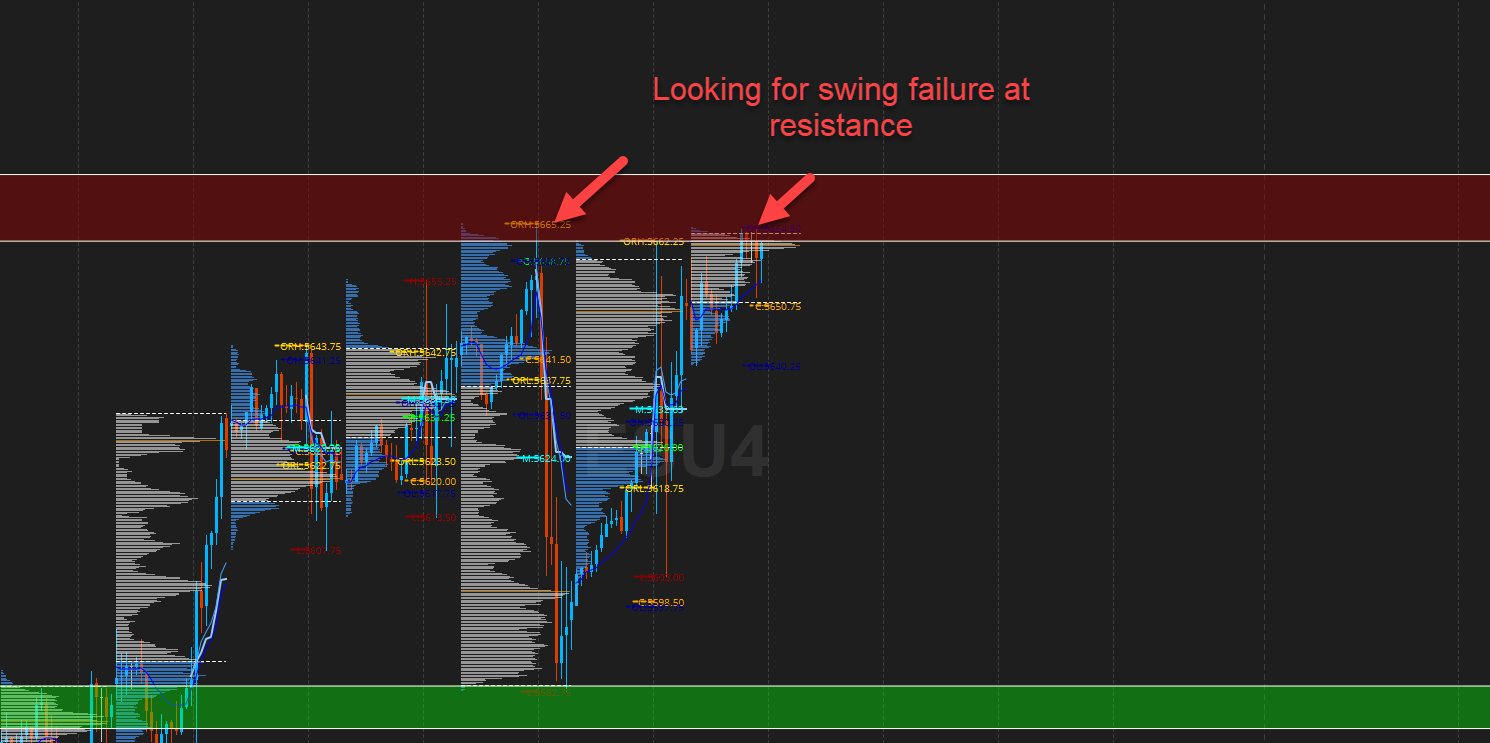

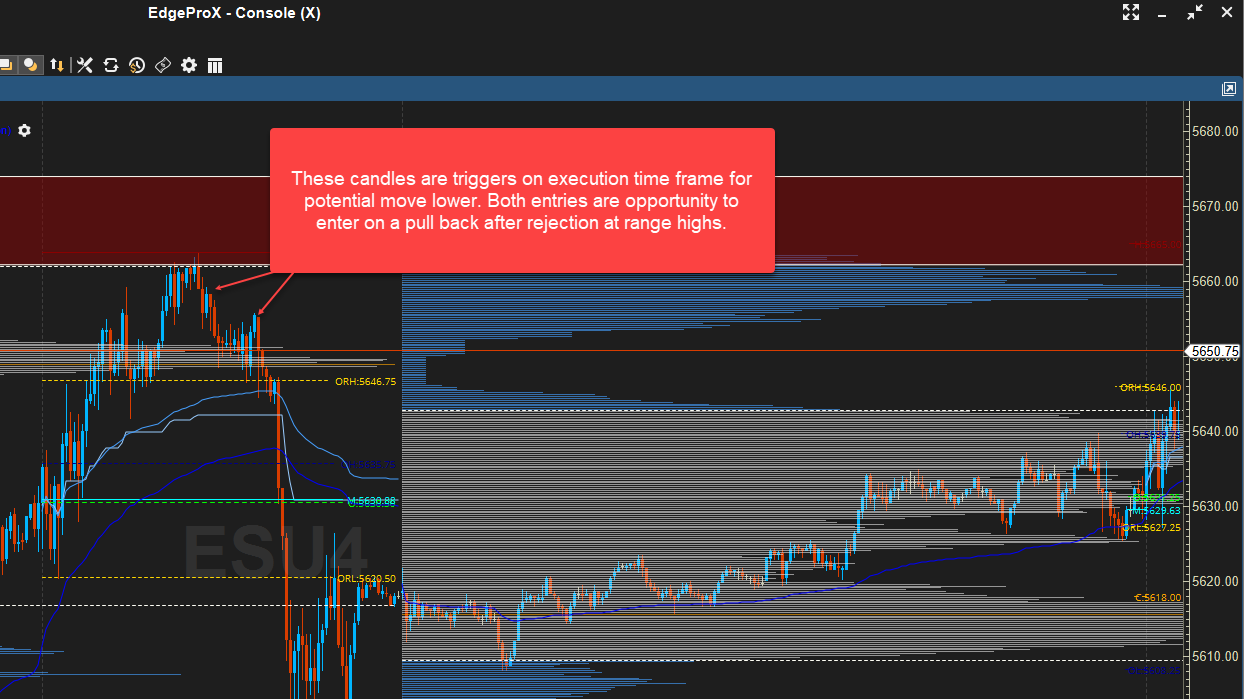

2. Swing Failure Long/Short

A swing failure occurs when a resistance or support zone is tested, and a failure candle—such as a hammer, gravestone doji, or inverted hammer—forms. This pattern is then followed by price action confirming bearish or bullish reversal. This setup can be executed on 60-minute, 30-minute, or 5-minute time frames, depending on the context and trade idea. The image below illustrates this pattern!

In the video below, you can see this trade play out on execution time frame:

Past performance is not indicative of future results

3. Rounded Retest/Fade Trade

When looking at Support Resistance zones on a higher time frame, the trade idea is to go long. However, for the trade idea to be valid, we need to see a candle close above support before executing the trade on the long side during a pullback. Until then, it’s a wait-and-see approach. If the market stays below, it may either break lower or trap shorts until it moves back into range.

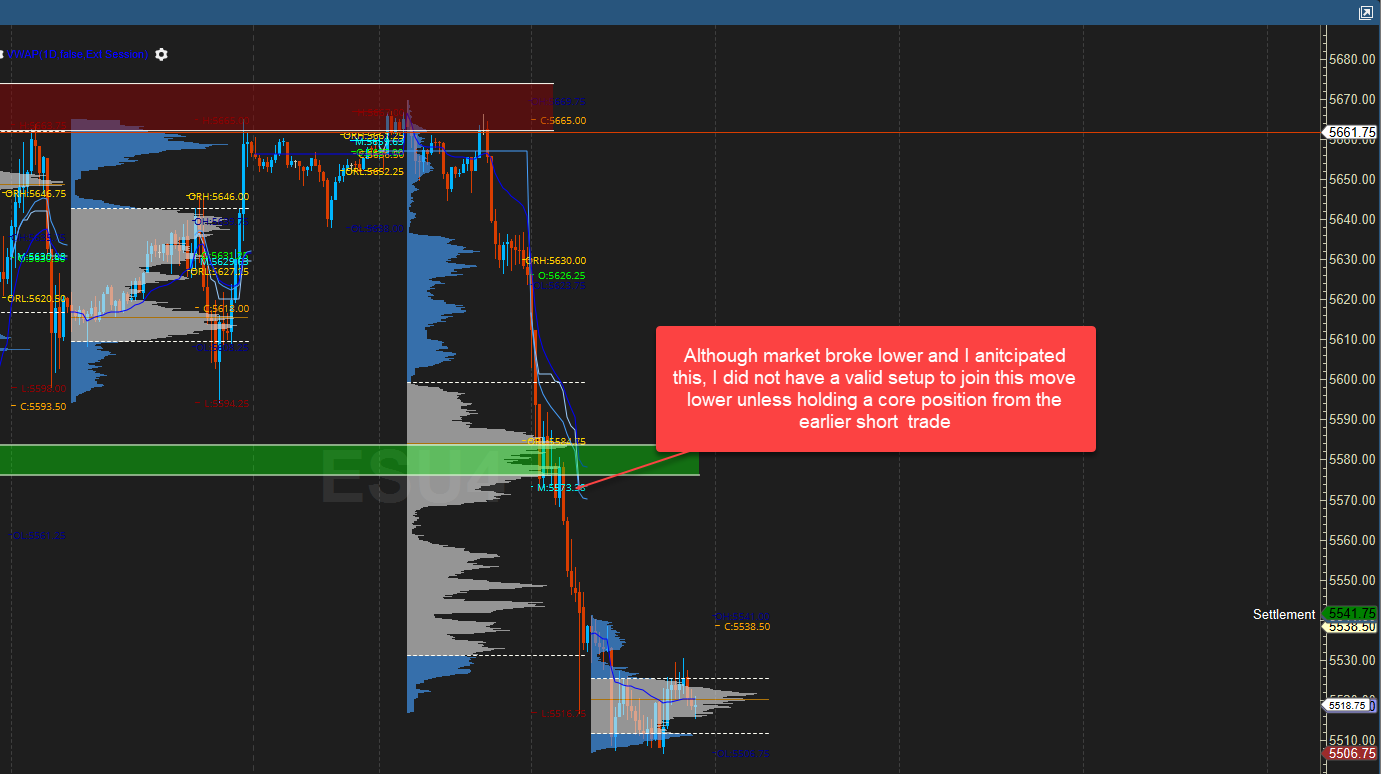

Although market broke lower and I anticipated this, I did not have a valid setup to join this move lower unless holding a core position from the earlier short trade in VWAP strategy.

The trade set up never came to fruition in the image above. The market broke lower and is now consolidating. Hence why it is also important to understand trade setup and how to execute it. In the video below, you can see this trade play out on execution time frame!

Past performance is not indicative of future results

Here is an example where this trade played out.

Here is a complete walk thru of this trade playing out on the execution time frame:

Past performance is not indicative of future results

Conclusion

Navigating the futures market is a journey that demands more than just an understanding of basic principles. Instead, it requires a blend of advanced strategies, continuous adaptation, and a deep understanding of market mechanics. A well-rounded approach to futures trading involves utilizing technical analysis, understanding market theories, and implementing effective trading strategies. I will leave you with this—refine your techniques, stay curious, and remember, some of the best traders are those who embrace the challenges and opportunities the market offers. Here’s to your journey in the futures market, may it be as fulfilling as it is dynamic!

Looking to discuss any of these strategies further or to gain some expert guidance? Fill out the contact form below and an EdgeClear team member will be in contact with you soon!

Disclaimer: The views expressed are personal opinions and should not be interpreted as financial advice.