July 30,2024 @08:21 AM

Entering a high-stakes poker table that has a $200 minimum buy-in with only $200 is akin to putting all of your money into a single hand. Like a coin flip, you are leaving your fate to chance, and will likely miss out on profitable situations when you aren’t in play. This analogy mirrors what may happen to a trader who enters the futures market without a trading plan. It is extremely important for traders to have a refined trading plan that they can execute every trading day to establish consistency while minimizing the likelihood of risks.

Building A Trading Plan

Creating a trading plan is not a ‘one size fits all’ process; it is specialized to a trader’s goals, trading style, and risk tolerance. A trading plan serves as a foundational blueprint for traders—with disciplined trading practices that promote risk management techniques, consistency, objective decision-making, accountability, and more. It’s also a living document that must be updated periodically alongside market changes and as the trader iterates. Ultimately, a trading plan should be something that a trader could hand to an investor and they would be able to understand their approach, objectives, risks, growth plan, and how they measure progress.

Below are 4 questions that I believe are paramount for any trader that wants to create a successful trading plan.

- What is my timeframe? How long will this plan be tested before I deem it has an

edge or not?

This is a crucial question to ask when formulating a trading plan as it constructs a baseline for you to stick to, ensuring that you are properly funded as a trader, managing risk, and truly devoted to your plan.

Additionally, in order to determine viability, we must establish a time frame in which we would anticipate improvement, consistency, or that this plan is not working. Think of any business plan, if you are like Google and have nearly unlimited capital, you can afford extensive experimentation to see what sticks.

On the other hand, if you’re a startup and have limited resources and funds, you need to know what works, what doesn’t, and what needs to be scrapped within a swift timeframe.

- What performance benchmarks should I aim for to validate this plan?

Everyone should want to strive to have goals that are challenging, yet attainable. If it wasn’t difficult, then everyone would do it! These benchmarks are what keeps you driven, continuously seeking improvement, and resilient enough to return back the next day even after encountering setbacks. These need to be concrete and measurable performance targets, not unrealistic fantasies such as, “I am going to turn my $1,000 into $1 Million in four weeks”. Consistent trading and development is hardly ever glamorous in my opinion, and this isn’t Wall Street Bets.

Instead, you should center your trading objectives around these performance

bench markers:

- Adhering To Your Trading Plan — Start with a solid foundation by creating

a trading plan that aligns with your trading style, risk management rules,

and goals. It is also extremely important to remain consistent with this

plan, as deviating from it and making impulsive decisions may cause

increased losses. Be sure to remain vigilant of market news, your trading

preferences, and the products you’re trading, as it may be beneficial to

adjust your plan to meet your goals.

- Risk/Reward Ratio — Aim to retain a positive risk-to-reward ratio by

taking the total profit target and dividing it by the maximum risk price. In

doing so, you will be able to evaluate the ratio compared to your threshold

and make any necessary changes to continue towards your goals. - Position Sizing — Having proper position sizing serves as a safeguard

against having too much risk within a single trade. Implementing position

sizing into your trades will also help to limit losses when you are

beginning to trade. - Daily Consistency — Instead of making goals for huge profits in a short

time, you should aim to achieve consistent daily targets. This will help you

to instill discipline within your trades, while avoiding unnecessary risks.

By taking the time to focus on these benchmarks, you can build a strong plan for long-term sustainable trading.

- How will I gauge the effectiveness of my performance?

I think that this is a really important question. Having been deeply involved in

athletics for much of my life, I will often look at things with a competitive

perspective. However, I have been surprised to learn that this attitude does

not translate very well into the world of trading, where calmness and

patience are vital. Trading is all about following a model or strategy with no

deviations. Exerting additional effort during the trading day is not only

unnecessary, but it can also be detrimental. The market’s randomness means

that strictly following your model can help you to extract profits on a long-term

scale. Any deviations or extra effort will undermine the edge from your strategy.

It is very important to recognize that trading is not and should not be a

perfection-seeking activity, which is similar to some people’s mindset towards

competitive sports. Instead, trading should be about adhering to your trading

plan, set rules, and strategies. Success in athletics comes from the scoreboard,

which reflects back to an athlete’s training, discipline, and knowledge of the sport.

Within trading, success is measured not by the profits you make in a single day,

but by how well you stick to your model. Maintaining your strategy overtime, even

through market volatility, is what will lead you towards long-term profitability. By

doing this, you maintain your edge and become less likely to submit to

emotion-led choices in an attempt to “outperform” the market.

When evaluating your performance, you should focus on specific areas such as:

● Am I committing fewer errors with this new plan?

● Am I seeing an improvement in my P/L over time?

● Am I taking better trades with a better risk/reward profile?

● Do I feel comfortable trading this plan? Do I feel less stressed? Am I

in-tune with what I need to see to execute?

- How will I be able to scale up the size I am trading?

Gaining greater trading volume takes time and requires a mindful evaluation of a

handful of factors. When beginning to consider increasing the quantity traded,

you should consider the following points:

● It is essential to ensure that you are aligned with all of your objectives in

your plan. Are you meeting your performance goals? Do you have a

sufficient sample size to see that this trading plan has an edge? If so, you

may want to consider sizing up your trades.

● However, there are some additional factors that need to be considered.

Do you have the necessary capital to size up? While you may have the

amount needed, it is extremely important to think about whether your

current account size justifies a move.

● You should also assess the liquidity of the product you are trading. Does

your product have enough liquidity to size up? Will you start to incur

slippage that would affect your overall stats if you scale up?

● All of this should be taken into account. I have talked with countless

traders that feel they must size up to see positive returns on their plan, so

even though their plan has an edge, they think they are not seeing gains

fast enough. That, in my opinion, is a slippery slope to the “blow up” trade.

Make sure you are ready for the size before committing to it, and once

you commit, stick to the plan!

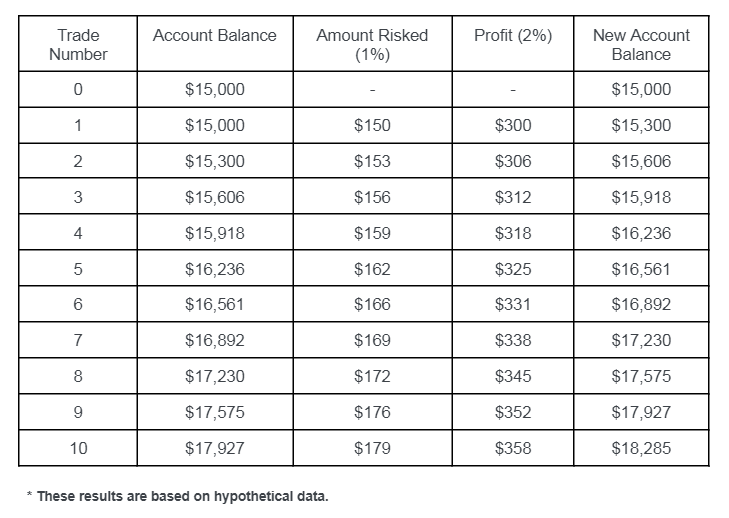

Implementing a disciplined approach with risk management techniques can help

you to gain traction and notable profits. View the table below to see how a

$15,000 account with a 1% risk plan can help the account to grow over time.

Risk Management & Accountability

In my experience trading, it is extremely important to have a trading partner that understands your plan and can hold you to it day in and day out. You can have a great trading plan, but if it isn’t executed every trading day then you have lost your edge. If you are not accountable to anyone, it becomes much easier to sweep errors under the rug and not address them properly to ensure you won’t do it again. I encourage you to find a trading partner or group that you can do frequent check-ins with—this partner could be a spouse, friend, broker, or anyone that you can confide in on your good days and bad days.

Funding

The perspective I hold on funding has remained pretty consistent and is set upon two key elements. Firstly, you should fund with the risk capital that you are comfortable with. Risk capital would be defined as the funds whose potential would not affect your day-to-day lifestyle or your retirement horizon. As illustrated below, this may mean that you need to scale down to trade a product that is smaller than what you originally wanted to trade.

Secondly, if you have the available risk capital, aim to fund with 100% of the Initial Margin per contract that you intend to trade. For example, if your strategy calls for trading up to 3 E-Mini SP Futures, with each requiring an Initial Margin of $12,980 per contract, fund with close to $40,000. If it is not feasible for you to fund with that amount of risk capital, try to reach at least 50% of that amount. Alternatively, you may also need to consider sizing down your position or look into trading Micros.

Initial Margin

Initial Margin represents the minimum funds that the CME requires to initiate a Futures position. This amount is already leveraged, typically at around 5% of the Notional Value of a contract for something like the E-Mini S&P Futures.

However, it’s important to note that if you are day trading with margins that are less than the required Initial Margin, these positions may not be carried overnight. Brokers often provide day margin, allowing you to enter positions with sometimes less than 0.5% of the Notional Value per contract for intraday trading.

The additional funding serves as extra buying power, which equates to having more chips at the poker table. However, it’s crucial to remember that this increased leverage also comes with heightened potential for losses. Many traders, including myself, have experienced the stress of trading with a significant margin, thinking, “I have to win this trade to stay around for the next trade.” Such situations are very stressful and not conducive to successful trading. Stress and heightened emotions can impair decision making and lead to poor trading outcomes.

In Closing

Making a trading plan is not supposed to be easy. It requires patience, strong market understanding, confidence in your trading and sense of self, and the mental resilience to get back up when things do not go to plan. There are many components that make up a trading plan and it can be overwhelming, but take it one step at a time. Remember, the market will be here tomorrow, devote your time to your plan and improving yourself, and it is ok to take days off with no trades. Plan the trade, and trade the plan.

Disclaimer: Derivatives trading involves a substantial risk of loss and is not suitable for all investors.

Opinions expressed are solely their own opinions and do not reflect the opinions of EdgeClear.

~Ian Blanke, Director of Brokerage Services